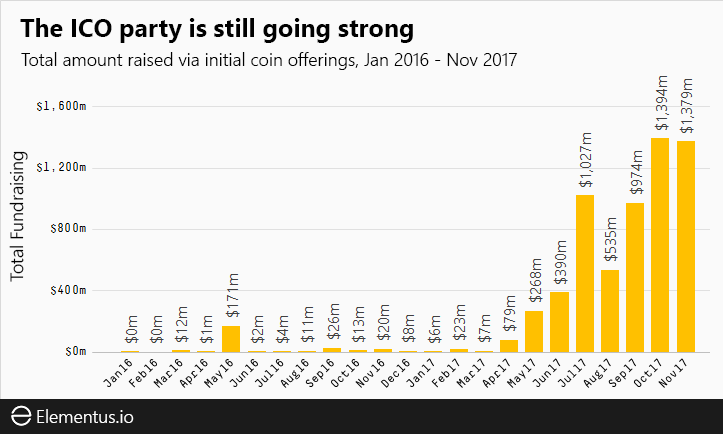

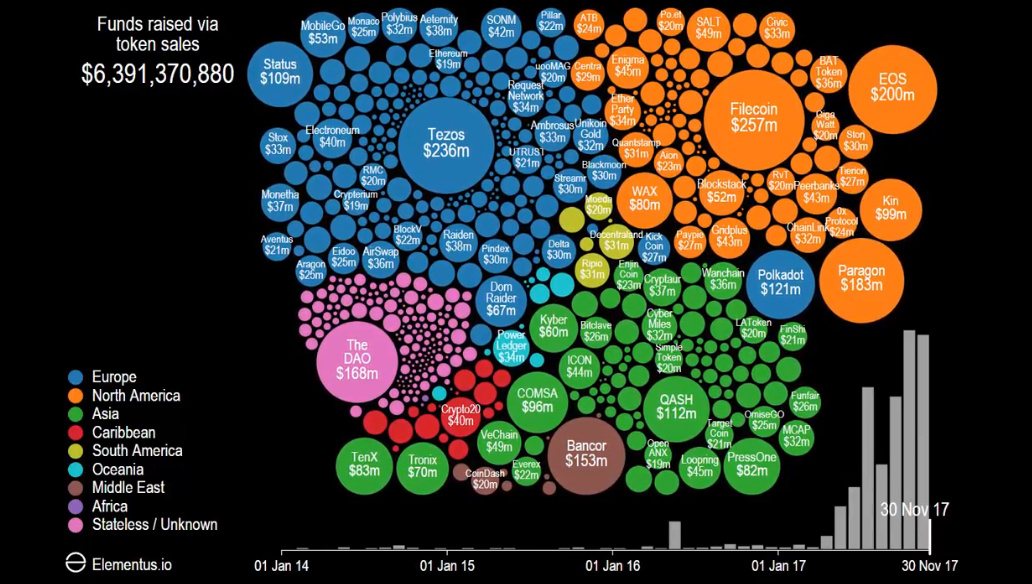

ICOs have become so popular that well over 90% of total funds raised through this mechanism came from this year alone. While it’s hard to put this sudden ICO explosion in context, we think today’s animation does the phenomenon sufficient justice. Coming from Max Galka at Elementus.io, today’s animation shows a timeline of ICOs and funds raised since early 2014. In an added dimension, each ICO is also classified based on geographic region. The colorful fireworks that happen throughout 2017 help to make it clear that we are indeed living in the year of the ICO.

Year of the ICO

Despite bans in China and South Korea, there is no shortage of fervor for new cryptocurrencies or tokens.

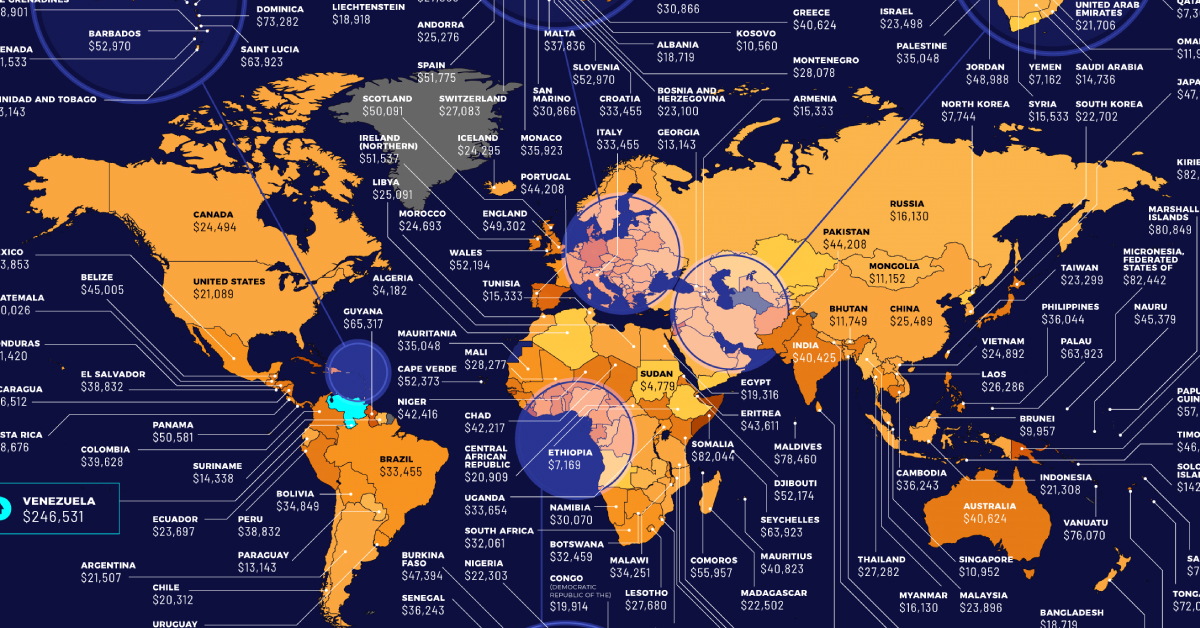

In their short history, there have been three ICOs that raised over $200 million – and six more that surpassed the $100 million mark. Here is a breakdown of the nine biggest ICOs so far. Note that eight of them took place in 2017: It’s worth mentioning that with the price for bitcoins and ether both rising fast, that these ICOs have actually raised even more capital than initially shown. That’s because the dollar amounts above are based on the value of bitcoins and ether at the time of the raise. With billions in capital going into new projects, investors and speculators are anxiously waiting to see which coin or token will be the next Ethereum to take the market by storm. on It takes an estimated 1,449 kilowatt hours (kWh) of energy to mine a single bitcoin. That’s the same amount of energy an average U.S. household consumes in approximately 13 years. Given the high amount of energy needed to mine bitcoin, it can be a costly venture to get into. But exact prices fluctuate, depending on the location and the cost of electricity in the area. Where are the cheapest and most expensive places to mine this popular cryptocurrency? This graphic by 911 Metallurgist provides a snapshot of the estimated cost of mining bitcoin around the world, using pricing and relative costs from March 23, 2022.

How Does Bitcoin Mining Work?

Before diving in, it’s worth briefly explaining the basics of bitcoin mining, and why it requires so much energy. When someone mines for bitcoin, what they’re really doing is adding and verifying a new transaction record to the blockchain—the decentralized bank ledger where bitcoin is traded and distributed. To create this new record, crypto miners need to crack a complex equation that’s been generated by the blockchain system. Potentially tens of thousands of miners are racing to crack the same code at any given time. Only the first person to solve the equation gets rewarded (unless you’re part of a mining pool, which is essentially a group of miners who agree to combine efforts to increase their chances of solving the equation). The faster your computing power is, the better your chances are of winning, so solving the equation first requires powerful equipment that takes up a lot of energy.

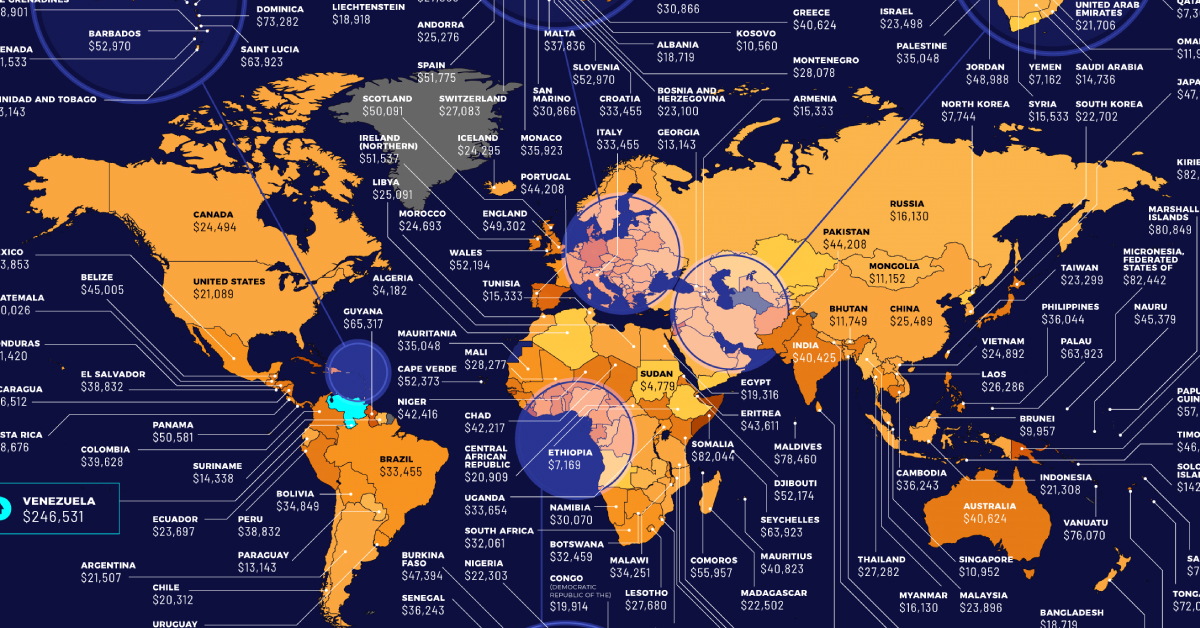

The Costs and Profits of Mining Bitcoin in 198 Countries

Across the 198 countries included in the dataset, the average cost to mine bitcoin sat at $35,404.03, more than bitcoin’s value of $20,863.69 on July 15, 2022. Though it’s important to note that fluctuating energy prices, and more or less miners on the bitcoin network, constantly change the necessary energy and final cost.

Here’s a breakdown of what the cost to mine one bitcoin in each country was in March 23, 2022, along with the potential profit after accounting for mining costs:

Venezuela ranks as the number one most expensive country to mine bitcoin. It costs a whooping $246,530.74 to mine a single bitcoin in the South American country, meaning the process is far from profitable. Energy costs are so expensive in the country that miners would be out $225,667.05 for just one bitcoin.

On the opposite end of the spectrum, the cheapest place to mine bitcoin is in Kuwait. It costs $1,393.95 to mine a single bitcoin in Kuwait, meaning miners could gain $19,469.74 in profits.

The Middle Eastern country has some of the cheapest electricity in the world, with one kWh costing an average of just 3 cents. For context, the average cost of one kWh in North America is 21 cents.

The Race is On

Despite the steep costs of bitcoin mining, many people believe it’s worth the upfront investment. One thing that makes bitcoin particularly appealing is its finite supply—there are only 21 million coins available for mining, and as of this article’s publication, more than 19 million bitcoin have already been mined. While the price of bitcoin (BTC) is notorious for its volatility, its value has still grown significantly over the last decade. And if cryptocurrencies become mainstream as many people believe they will, this could boost the price of bitcoin even further.