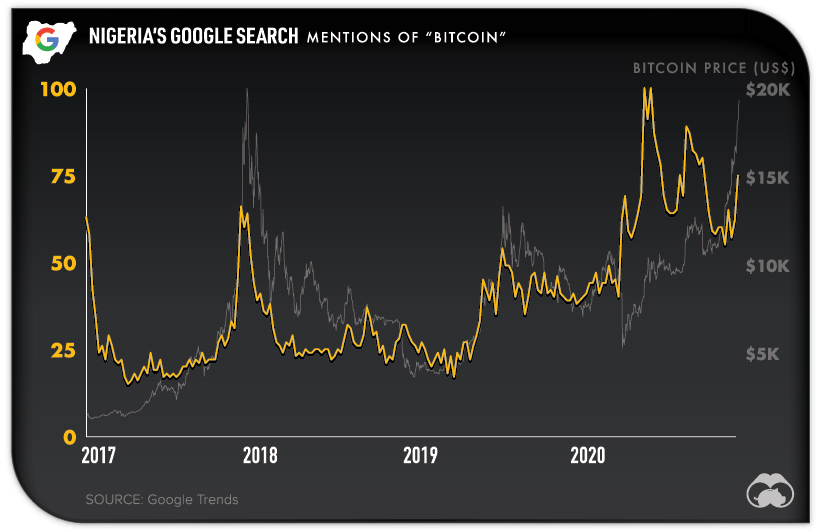

Up more than 300% from the March lows, bitcoin is within $1,000 of its all-time high ($19,891) established three years ago. While 2017’s run-up saw a huge surge in Google searches, interest this time around is less than a quarter of what it was back then. This graphic overlays bitcoin’s price changes against Google search interest for “bitcoin” between 2017-Nov 2020, showing the muted relative search interest for its recent rally. Despite Google search interest being low, it is turning upwards, potentially hinting at a rise to cap off 2020.

Nobody’s Searching? Maybe Bitcoin is Already Mainstream

Bitcoin’s mainstream attention in 2017 was exceptional, and was likely the first time many people had even heard about the digital asset.

After doing all of their Google research back then, it’s possible that the general population is now well aware of the cryptocurrency and doesn’t need to search up the basics again. Add to this that bitcoin is now easily purchasable through popular services like Robinhood and Paypal, and you have fewer people who need Google to figure out the intricacies of bitcoin wallets and transactions.

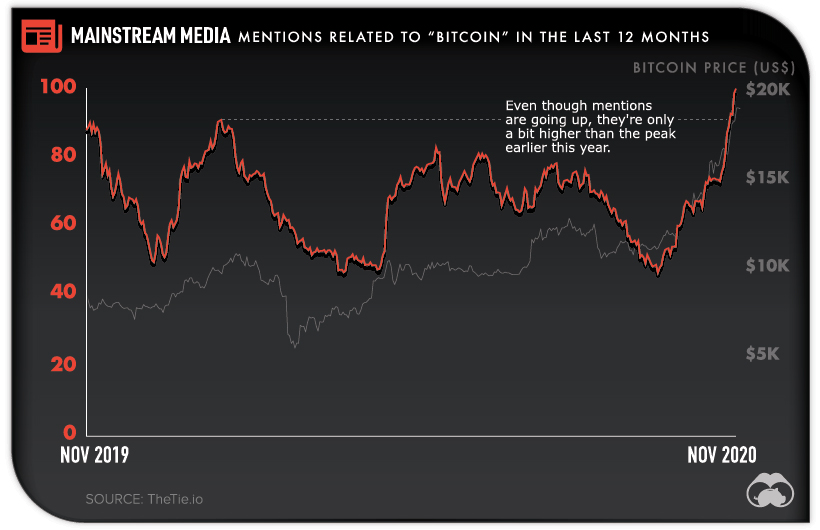

While people might not be searching for information on bitcoin, the media has certainly picked up on its movement over the past year. Mainstream coverage regarding the cryptocurrency is currently at a relative all-time high for the past 12 months.

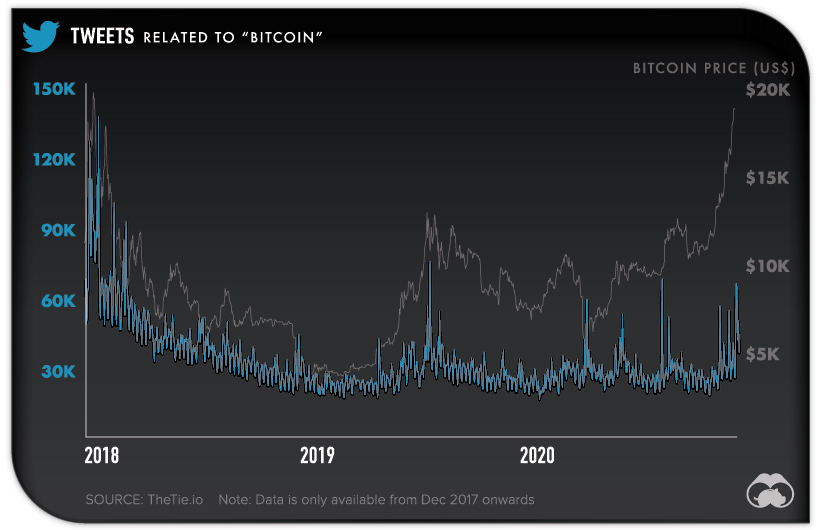

Even if current mainstream coverage isn’t far from previous peaks, it’s still likely that people are seeing an increase in bitcoin content in their news feeds following the recent surge. This rally is also attracting increased talk on social media sites like Twitter. That said, while there has been a rise in the volume of bitcoin-related tweets in November 2020, numbers are still quite low compared to the amount of tweets in 2017.

Daily tweet volume reached above 60,000 recently, but is still far from the +100,000 daily tweets that were being sent at the top of 2017’s bull run.

Where in the World is Google Search Interest for Bitcoin?

Even if worldwide search interest isn’t as high as it was in 2017, there is one country where bitcoin is being googled more now: Nigeria. Since 2015, the Nigerian Naira has lost more than 50% of its value against the U.S. dollar. This, coupled with the country’s high share of unbanked citizens means that alternative currencies and payment methods have steadily risen in popularity and utility.

FinTech startups like Chipper Cash are providing Nigeria and other African nations with no-fee P2P payment services, along with the ability to trade bitcoin. The service is also beta testing the buying and selling of fractional shares of popular U.S. stocks. Started up in 2018, Chipper Cash’s monthly payment values are now over $100 million, and the company has attracted investment from top VC funds like Bezos Expeditions as they provide a valuable service in an emerging market.

If Bitcoin is Mainstream, Where Does It Go From Here?

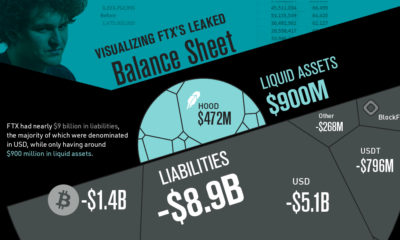

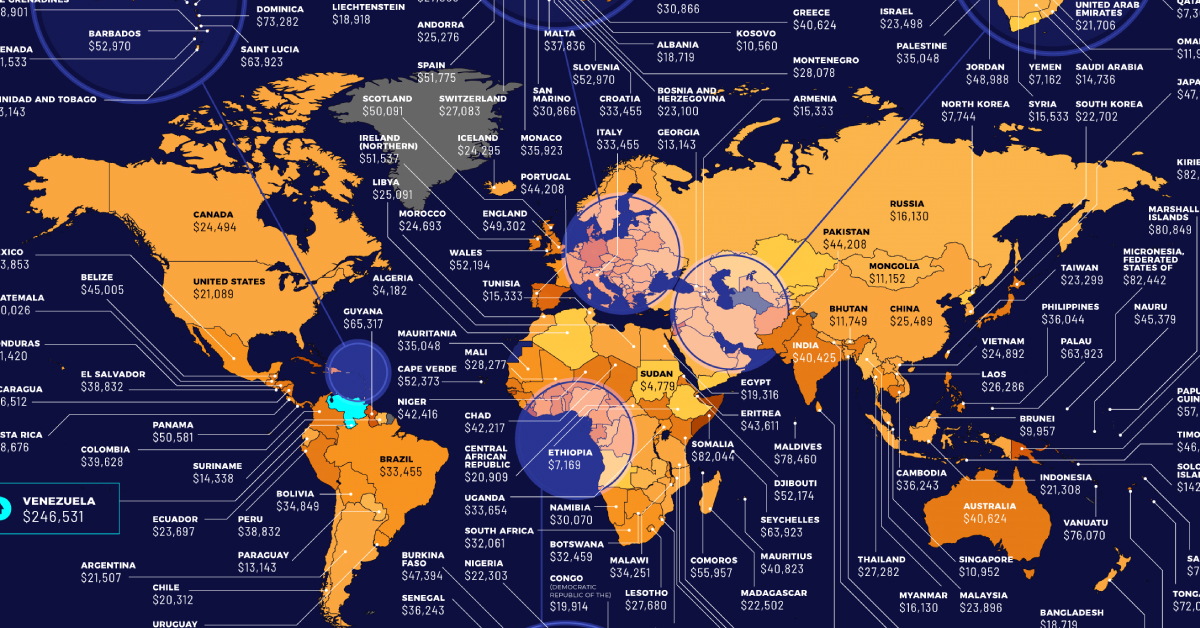

While bitcoin is proving itself to be a useful medium of exchange around the world, it’s still primarily a speculative asset. As 2020 saw massive increases in money supply across the board, bitcoin reacted best compared to other speculative assets, with its ascent to $19,000 almost completely uninterrupted since the $10,000 price area. Time will tell if 2017 is set to repeat itself, or if bitcoin is getting ready to set new all-time highs going into 2021. on It takes an estimated 1,449 kilowatt hours (kWh) of energy to mine a single bitcoin. That’s the same amount of energy an average U.S. household consumes in approximately 13 years. Given the high amount of energy needed to mine bitcoin, it can be a costly venture to get into. But exact prices fluctuate, depending on the location and the cost of electricity in the area. Where are the cheapest and most expensive places to mine this popular cryptocurrency? This graphic by 911 Metallurgist provides a snapshot of the estimated cost of mining bitcoin around the world, using pricing and relative costs from March 23, 2022.

How Does Bitcoin Mining Work?

Before diving in, it’s worth briefly explaining the basics of bitcoin mining, and why it requires so much energy. When someone mines for bitcoin, what they’re really doing is adding and verifying a new transaction record to the blockchain—the decentralized bank ledger where bitcoin is traded and distributed. To create this new record, crypto miners need to crack a complex equation that’s been generated by the blockchain system. Potentially tens of thousands of miners are racing to crack the same code at any given time. Only the first person to solve the equation gets rewarded (unless you’re part of a mining pool, which is essentially a group of miners who agree to combine efforts to increase their chances of solving the equation). The faster your computing power is, the better your chances are of winning, so solving the equation first requires powerful equipment that takes up a lot of energy.

The Costs and Profits of Mining Bitcoin in 198 Countries

Across the 198 countries included in the dataset, the average cost to mine bitcoin sat at $35,404.03, more than bitcoin’s value of $20,863.69 on July 15, 2022. Though it’s important to note that fluctuating energy prices, and more or less miners on the bitcoin network, constantly change the necessary energy and final cost.

Here’s a breakdown of what the cost to mine one bitcoin in each country was in March 23, 2022, along with the potential profit after accounting for mining costs:

Venezuela ranks as the number one most expensive country to mine bitcoin. It costs a whooping $246,530.74 to mine a single bitcoin in the South American country, meaning the process is far from profitable. Energy costs are so expensive in the country that miners would be out $225,667.05 for just one bitcoin.

On the opposite end of the spectrum, the cheapest place to mine bitcoin is in Kuwait. It costs $1,393.95 to mine a single bitcoin in Kuwait, meaning miners could gain $19,469.74 in profits.

The Middle Eastern country has some of the cheapest electricity in the world, with one kWh costing an average of just 3 cents. For context, the average cost of one kWh in North America is 21 cents.

The Race is On

Despite the steep costs of bitcoin mining, many people believe it’s worth the upfront investment. One thing that makes bitcoin particularly appealing is its finite supply—there are only 21 million coins available for mining, and as of this article’s publication, more than 19 million bitcoin have already been mined. While the price of bitcoin (BTC) is notorious for its volatility, its value has still grown significantly over the last decade. And if cryptocurrencies become mainstream as many people believe they will, this could boost the price of bitcoin even further.