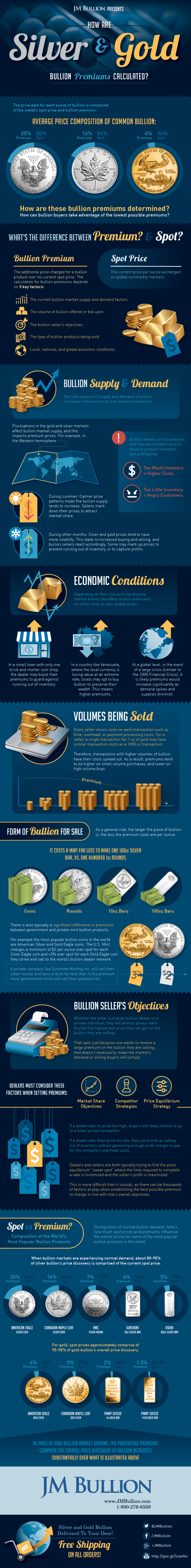

How are Silver and Gold Bullion Premiums Calculated?

The price paid for each ounce of bullion is composed of the metal’s spot price and the bullion premium. Here’s the price composition of some common rounds:

Silver Eagle: 80% spot price / 20% bullion premium Silver Canadian Maple Leaf: 84% spot price / 16% bullion premium Gold Eagle: 96% spot price / 4% bullion premium

How are these bullion premiums determined? How can bullion buyers take advantage of the lowest possible premiums?

Difference Between Spot Prices and Bullion Premiums

Spot Price: The current price per ounce exchanged on global commodity markets. Bullion Premium: The additional price charged for a bullion product over its current spot price. The calculation for bullion premiums depends on five key factors:

The current bullion market supply and demand factors. Local, national, and global economic conditions. The volume of bullion offered or bid upon. The type of bullion products being sold. The bullion seller’s objectives.

Bullion Supply and Demand

The total amount of supply and demand of bullion is a major influence on bullion product premiums. Bullion dealers are businesses, and they are actively trying to balance product inventory and profitability. Too much inventory means high costs. Too little inventory means angry customers. Fluctuations in the gold and silver markets affect bullion market supply, and this impacts premium prices. For example, in the Western hemisphere during the summer, calmer price patterns mean the bullion supply tends to increase. Sellers mark down their prices to attract market share. During other months, silver and gold prices tend to have more volatility. This leads to increased buying and selling, and bullion sellers react accordingly. Some may mark up prices to prevent running out of inventory, or to capture profits.

Economic Conditions

Depending on their size and significance, market events can affect bullion premiums local to global stages. Examples:

In a small town with only one brick and mortar coin shop, the dealer may boost their premiums to guard against running out of inventory. In a country like Venezuela, where the local currency is losing value at an extreme rate, locals may opt to buy bullion to preserve their wealth. This means higher premiums. At a global level, in the event of a large crisis (similar to the 2008 Financial Crisis), it is likely premiums would increase significantly as demand spikes and options diminish.

Volumes Being Sold

Every seller incurs costs on each transaction such as time, overhead, or payment processing costs. For a seller, a single transaction for 1 oz of gold may have similar transaction costs as a 1000 oz transaction. Therefore, transactions with higher volumes of bullion have their costs spread out. As a result, premiums tend to be higher on small volume purchases, and lower per oz on high volume buys.

Form of Bullion for Sale

As a general rule, the larger the piece of bullion is, the less the premium costs are per oz.

It costs a mint far less to make one 100 oz silver bar, vs. 100 rounds of 1 oz each.

There is also typically a significant difference in premiums between government and private mints.

For example the most popular bullion coins in the world are American Silver and Gold Eagle coins. The U.S. Mint charges a minimum of $2 oz over spot for each Silver Eagle coin and +3% over spot for each Gold Eagle coin they strike and sell to the world’s bullion dealer network.

A private company like Sunshine Minting will sell their silver rounds and bars in bulk for less than ½ the premium most government mints will sell their products for.

Bullion Seller’s Objectives

Whether the seller is a large bullion dealer or a private individual, they will almost always want to yield the highest ask price they can get for the bullion they are selling. That said, just because one wants to receive a large premium on the bullion they are selling, that doesn’t necessarily mean the market’s demand or willing buyers will comply. Dealers must consider these factors when setting premiums:

Market share objectives Competitor strategies Price equilibrium strategy

If a dealer sets its price too high, buyers will likely choose to go to a lower priced competitor. If a dealer sets their price too low, they could end up selling out of inventory without garnering enough profit margin to pay for the company’s overhead costs. Dealers and sellers are both typically trying to find the price equilibrium “sweet spot” where the time required to complete a sale is minimized and the seller’s profit is maximized. This is more difficult than it sounds, as there can be thousands of factors at play when establishing the best possible premium to charge in line with one’s overall objectives.

Price Composition for Bullion Products

When bullion markets are experiencing normal demand, about 80-95% of silver bullion’s price discovery is comprised of the current spot price. For gold, spot prices approximately comprise of 95-98% of gold bullion’s overall price discovery.

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.