This includes everything from the characteristics of an orebody to the actual extraction method envisioned and used—and the devil is often found in these technical details.

Part 4: Evaluating Technical Risks and Project Quality

We’ve partnered with Eclipse Gold Mining on an infographic series to show you how to avoid common mistakes when evaluating and investing in mining exploration stocks. Here is a basic introduction to some technical and project quality characteristics to consider when looking at your next mining investment.

View the three other parts of this series so far:

Mistakes made when choosing a team Mistakes made with the business plan Mistakes with project jurisdiction

Part 4: Technical Risks and Project Quality

So what must investors evaluate when it comes to technical risks and project quality? Let’s take a look at four different factors.

1. Grade: Reliable Hen Vs. Golden Goose

Once mining starts, studies have to be adapted to reality. A mine needs to have the flexibility and robustness to adjust pre-mine plans to the reality of execution.

A “Golden Goose” will just blunder ahead and result in failure after failure due to lack of flexibility and hoping it will one day produce a golden egg.

Many mining projects can come into operation quickly based on complex and detailed studies of a mineral deposit. However, it requires actual mining to prove these studies.

Some mining projects fail to achieve nameplate tonnes and grade once production begins. However, a team response to varying grades and conditions can still make a mine into a profitable mine or a “Reliable Hen.”

2. Money: Piggy Bank vs. Money Pit

The degree of insight into a mineral deposit and the appropriate density of data to support the understanding is what leads to a piggy bank or money pit. Making a project decision on poor understanding of the geology and limited information leads to the money pit of just making things work. Just like compound interest, success across many technical aspects increases revenue exponentially, but it can easily go the other way if not enough data is used to make a decision to put a project into production.

3. Environment: Responsible vs. Reckless

Not all projects are situated in an ideal landscape for mining. There are environmental and social factors to consider. A mining company that takes into account these facts has a higher chance of going into production. Mineral deposits do not occur in convenient locations and require the disruption of the natural environment. Understanding how a mining project will impact its surroundings goes a long way to see whether the project is viable.

4. Team: Orchestra vs. One-Man Band

Mining is a complex and technical industry that relies on many skilled professionals with clear leadership, not just one person doing all the work.

Geologists, accountants, laborers, engineers, and investor relations officers are just some of the roles that a CEO or management team needs to deliver a profitable mine. A good leader will be the conductor of the varying technical teams allowing each to play their best at the right time.

Mining 101: Mining Valuation and Methods

In order to further consider a mining project’s quality, it is important to understand how the company is valued and how it plans to mine a mineral resource.

Valuation

There are two ways to look at the value of a mining project:

Mining Method

The location of the ore deposit and the quantity of its grade will determine what mining method a company will choose to extract the valuable ore.

When Technicals and Quality Align

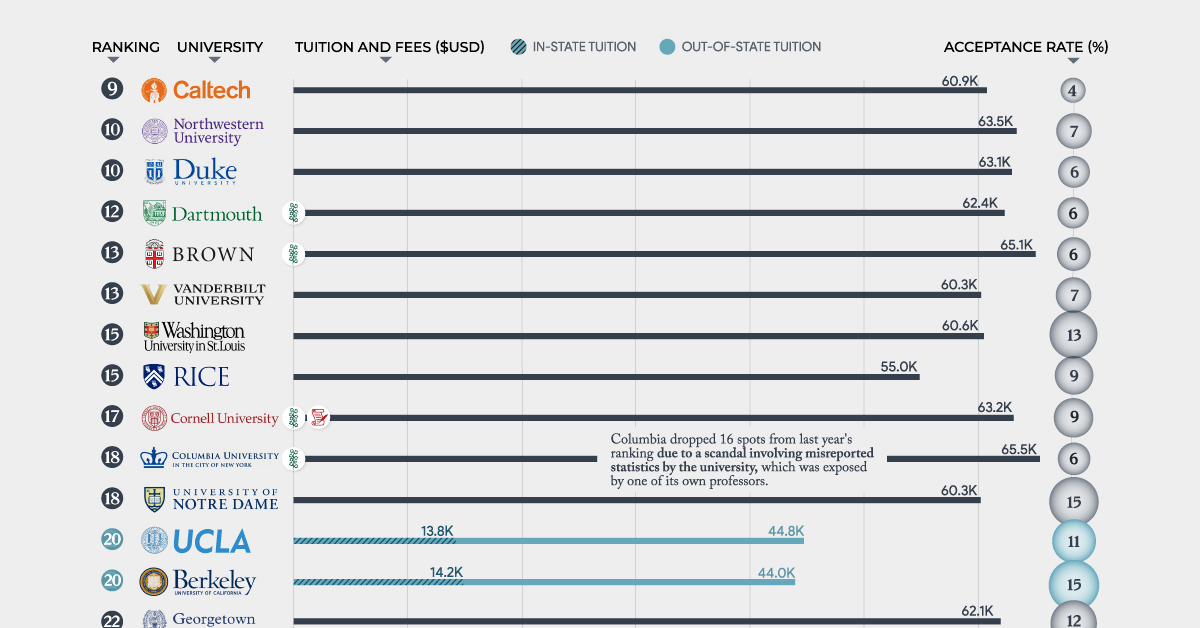

This is a brief overview of where to begin a technical look at a mining project, but typically helps to form some questions for the average investor to consider. Everything from the characteristics of an orebody to the actual extraction method will determine whether a project can deliver a healthy return to the investor. on But which schools are actually the best ones in America? This ranking uses data from U.S. News & World Report to rank America’s 50 best universities from the Ivy League to public institutions. Additionally, this visual shows the average tuition and acceptance rate of each school.

The Methodology

Here’s a look at how different categories are scored in the ranking. It is worth noting that U.S. News relies on each university’s independent reporting of data and information and does not standardize or corroborate the reported information themselves. How categories are weighted:

Graduation & Retention Rates = 22% Undergraduate Academic Reputation = 20% Faculty Resources = 20% Financial Resources per Student = 10% Graduation Rate Performance = 8% Student Selectivity for Fall Entering Class = 7% Social Mobility = 5% Graduate Indebtedness = 5% Average Alumni Giving Rate = 3%

The Top Schools

Ivy League universities are often assumed to be the top schools in America, but in reality, only four of the eight make the top 10. Here’s a closer look: One of the Ivies, Columbia University, actually dropped 16 spots from last year’s ranking due to a scandal involving misreported statistics by the university, which was exposed by one of its own professors. There have been critiques of the U.S. News & World Report ranking since, as it doesn’t provide a uniform set of standards for the universities, but lets them determine how they score their categories themselves. Among the top 10 schools admittance is very competitive, and none of the acceptance rates surpass the 7% mark. Massachusetts Institute of Technology (MIT), Stanford University, and Caltech are among the most difficult universities to get into, with only 4% of applicants receiving that exciting acceptance letter. On the flip side, the universities of Illinois and Wisconsin, for example, accept 60% of all applicants.

Types of Universities

A few more things to know—there are eight private schools in the U.S. that have earned the distinction of “Ivy League,” due to their history and prestige. A number of schools are also classified as land-grant universities—built on land which was essentially given to them by the U.S. government. This was in an effort to provide higher education to lacking communities across the country, and there is at least one in every state. These are the U.S.’ eight Ivy League Institutions:

Princeton University Yale University Columbia University Brown University Harvard University Cornell University Dartmouth University University of Pennsylvania

Beyond these prestigious academies, there are many high caliber institutions like The Ohio State University and the University of Wisconsin—both of which are land-grant universities. Among the top 50, there are another four land-grant universities:

University of Florida University of Georgia University of Illinois Cornell University

There is ripe controversy, however, surrounding land-grant universities, as, in many cases, the U.S. government funded these institutions through expropriated indigenous land.

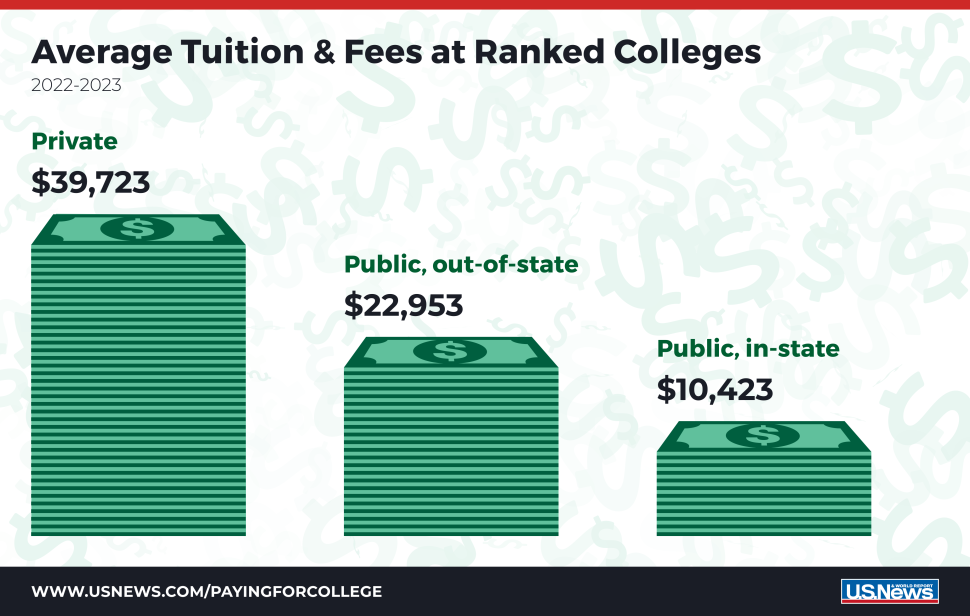

The Cost of an American Education

U.S. college tuition is famous for being unaffordable. Combining all the federal and private loans in the country, the total student debt comes out to $1.75 trillion and the average borrower owes $28,950. Here’s a look at how tuition breaks down on average:

The most expensive school in America is Columbia University, with the cost of admission coming out to a whopping $65,524, with some estimates showing even higher rates for the 2022/2023 academic year. The least expensive among the top 50 is the University of Florida at $6,380 for in-state tuition—more than 10x cheaper than Columbia. But many Americans may soon see their college loans forgiven. The Biden administration’s initiative to cancel student debt will roll out any day now and will be available on federal loans for select qualifying individuals. It has the potential to provide 40 million people with as much as $20,000 in debt forgiveness. And given that American universities make up eight of the 10 best universities in the world, perhaps the price tag will be worth it.