38 Incredible Facts on the Modern U.S. Dollar

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. We’ve previously showed you 31 Fascinating Facts About the Dollar’s Early History, which highlighted the history of U.S. currency before the 20th century. This was a very interesting period in which we looked at the money used by the first colonists, the extreme bust of the Continental currency, the era of privately-issued bank notes, and Congress’ emergency issuance of the fiat “greenback” during the Civil War. However, the modern era of the U.S. dollar is just as interesting. We have it starting in 1913, when the Federal Reserve Act was passed by Woodrow Wilson. Not only did it establish a new central bank, but it also gave the Fed the authority to issue the Federal Reserve Note, which is now the dominant form of U.S. currency both domestically and abroad.

A New Legal Tender

Leading up to the 20th century, there were four main forms of U.S. currency being used:

Gold and silver coins Gold and silver certificates Commercial bank notes, issued by private banks and backed by government bonds “Greenbacks”, a fiat currency declared legal by Congress to help fund the Civil War

In 1913, however, the Federal Reserve Note was authorized as U.S. currency. The new notes were supposed to be backed by gold or other “lawful money”, based on the stipulations of the Federal Reserve Act of 1913. However, this only lasted about 20 years. By the time of the Great Depression, the Fed considered itself to be in a tight spot. It simply did not have enough gold to back all Federal Reserve Notes and Gold Certificates in circulation, and at the same time wanted flexibility with monetary policy to fight deflation and unemployment. In 1933, the Emergency Banking Act was passed by President Roosevelt, and Executive Order 6102 was also signed. The latter move famously criminalized monetary gold, and ended the gold standard. After all, if gold can’t be legally owned, it can’t be legally redeemed.

Modern Paper Money

After a brief return to a pseudo gold standard after WWII, Nixon severed all remaining ties between gold and money in 1971. Since then, U.S. money has been purely fiat, and backed by the government rather than any physical commodity or precious metal. Some facts on today’s paper money:

There is $1.54 trillion of U.S. currency in circulation, and 97% of that is Federal Reserve Notes Over two-thirds of all $100 bills are held outside the U.S. Dollar bills can be folded at least 8,000 times, which is 20x more than a normal sheet of paper That’s because dollar bills are made of a special 75% cotton and 25% linen blend, patented by Crane & Co. The U.S. Bureau of Engraving and Printing produces 38 million notes every day, worth $541 million The two facilities, located in Washington, D.C. and Fort Worth, Texas use 9.7 tons of ink per day For 2017, the Fed ordered 7.1 billion new notes, worth $209 billion More than 70% of these notes are used to replace damaged ones Notes with smaller denominations ($1, $5, $10) tend to last for shorter periods of time, due to more frequent usage

Coins

The coins used today are similar to U.S. Federal Reserve Notes in that their face values tend to greatly exceed their intrinsic values. This is because cheaper metals such as copper, zinc, and nickel are used instead of gold or silver.

The average lifespan of a coin is 25 years, according to the U.S. Mint It’s estimated that Americans throw away around $62 million of coins every year In 2016, the U.S. Mint produced 16 trillion coins, valued at over $1.09 billion The amount of copper in a penny has fluctuated over the years. It ranges from 0% (in WWII, pennies were made of steel so copper could be used for ammunition) to 95%. Today’s pennies are 2.5% copper, with the remainder being 97.5% zinc

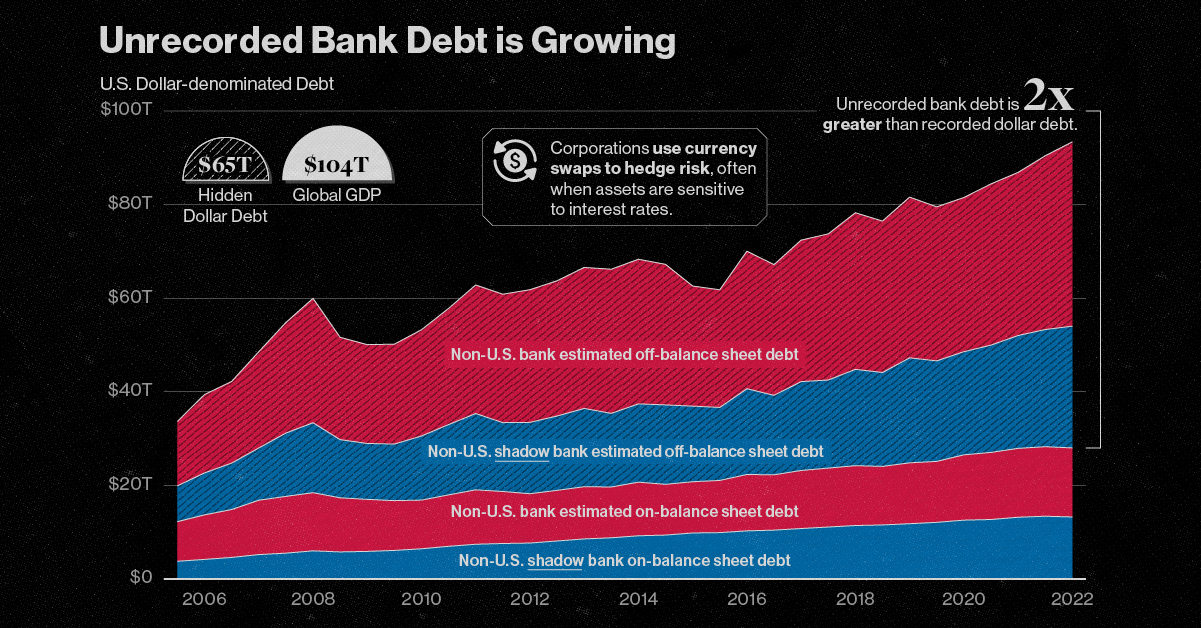

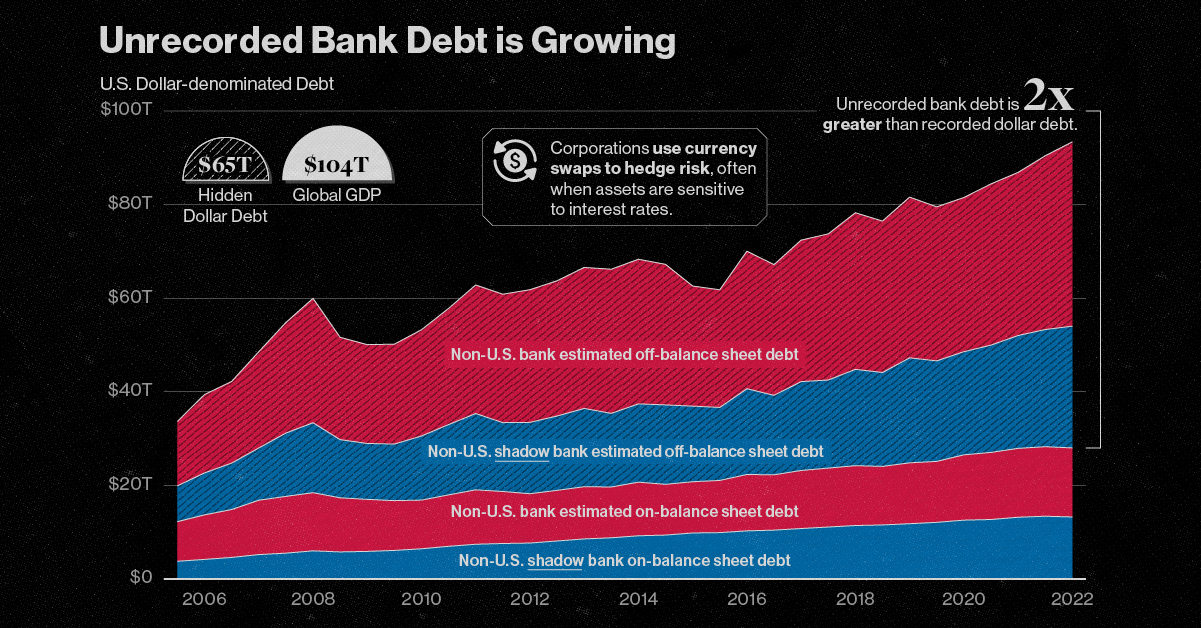

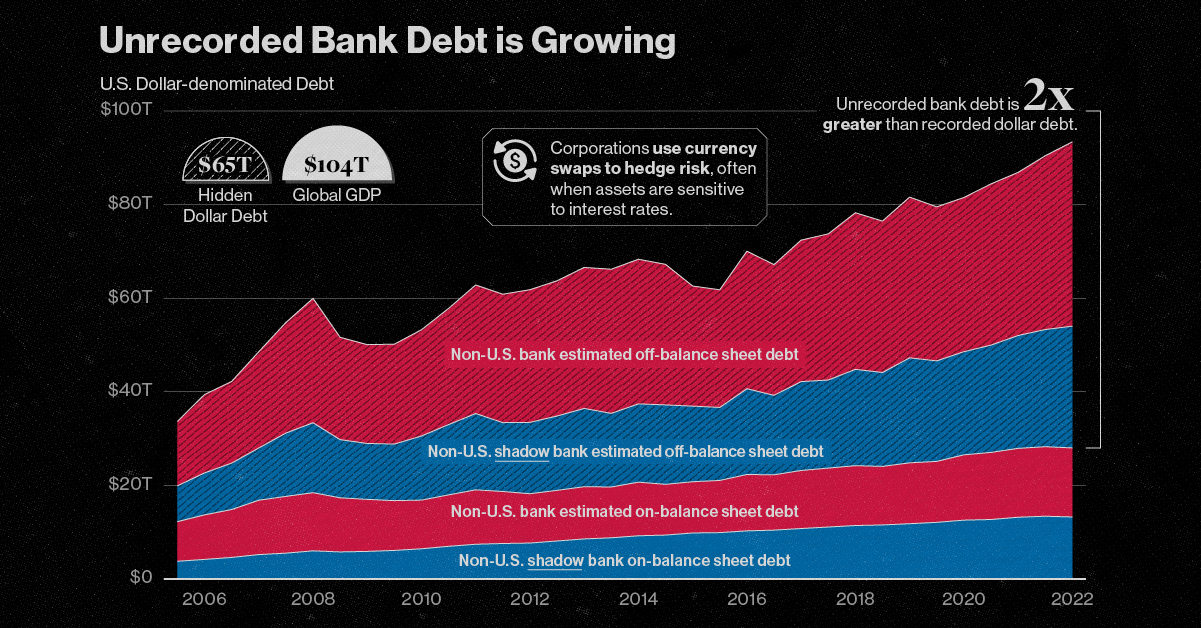

on The scale of hidden dollar debt around the world is huge. No less than $65 trillion in unrecorded dollar debt circulates across the global financial system in non-U.S. banks and shadow banks. To put in perspective, global GDP sits at $104 trillion. This dollar debt is in the form of foreign-exchange swaps, which have exploded over the last decade due to years of monetary easing and ultra-low interest rates, as investors searched for higher yields. Today, unrecorded debt from these foreign-exchange swaps is worth more than double the dollar debt officially recorded on balance sheets across these institutions. Based on analysis from the Bank of International Settlements (BIS), the above infographic charts the rise in hidden dollar debt across non-U.S. financial institutions and examines the wider implications of its growth.

Dollar Debt: A Beginners Guide

To start, we will briefly look at the role of foreign-exchange (forex) swaps in the global economy. The forex market is the largest in the world by a long stretch, with trillions traded daily. Some of the key players that use foreign-exchange swaps are:

Corporations Financial institutions Central banks

To understand forex swaps is to look at the role of currency risk. As we have seen in 2022, the U.S. dollar has been on a tear. When this happens, it hurts company earnings that generate revenue across borders. That’s because they earn revenue in foreign currencies (which have likely declined in value against the dollar) but end up converting earnings to U.S. dollars. In order to reduce currency risk, market participants will buy forex swaps. Here, two parties agree to exchange one currency for another. In short, this helps protect the company from unfavorable foreign exchange rates. What’s more, due to accounting rules, forex swaps are often unrecorded on balance sheets, and as a result are quite opaque.

A Mountain of Debt

Since 2008, the value of this opaque, unrecorded dollar debt has nearly doubled.

*As of June 30, 2022

Driving its rise in part was an era of rock-bottom interest rates globally. As investors sought out higher returns, they took on greater leverage—and forex swaps are one example of this.

Now, as interest rates have been rising, forex swaps have increased amid higher market volatility as investors look to hedge currency risk. This appears in both non-U.S. banks and non-U.S. shadow banks, which are unregulated financial intermediaries.

Overall, the value of unrecorded debt is staggering. An estimated $39 trillion is held by non-U.S. banks along with $26 trillion in overseas shadow banks around the world.

Past Case Studies

Why does the massive growth in dollar debt present risks? During the market crashes of 2008 and 2020, forex swaps faced a funding squeeze. To borrow U.S. dollars, market participants had to pay high rates. A lot of this hinged on the impact of extreme volatility on these swaps, putting pressure on funding rates. Here are two examples of how volatility can heighten risk in the forex market:

Exchange-rate volatility: Sharp swings in USD can spur a liquidity crunch U.S. interest-rate volatility: Sudden rate fluctuations can mean much higher costs for these trades

In both cases, the U.S. central bank had to step in to provide liquidity in the market and prevent dollar shortages. This was done through pumping cash into the system and creating swap lines with other non-U.S. banks such as the Bank of Canada or the Bank of Japan. These were designed to protect from declining currency values and a liquidity crunch.

Dollar Debt: The Wider Implications

The risk from growing dollar debt and these swap lines arises when a non-U.S. bank or shadow bank may not be able to hold up their end of the agreement. In fact, on a daily basis, there is an estimated $2.2 trillion in forex swaps exposed to settlement risk. Given its vast scale, this dollar debt could have greater systemic spillover effects. If participants fail to pay it could undermine financial market stability. Because demand for U.S. dollars increases during market uncertainty, a worsening economic climate could potentially expose the forex market to more vulnerabilities.