The fintech unicorn was just revalued at $9 billion after its latest round of funding led by General Catalyst Partners and CapitalG, the investment arm of Google’s parent company Alphabet Inc. The new financing, which almost doubled Stripe’s valuation, occurred despite a general slow-down in venture capital funding over recent months. Why are investors doubling down on Stripe? It’s because the company seems poised to continue revolutionizing online payments, and it’s creating a ripple effect that is spreading throughout the entire e-commerce landscape. The above infographic, courtesy of payment analytics software Control, gives insight into the rapidly evolving Stripe ecosystem – a key differentiating factor that investors are banking on with this five-year-old startup.

Breaking the mold

As is often the case with game-changing companies, Stripe was born out of frustration. Co-founders John Collison and Patrick Collison created the payment-processing platform after seeing an opportunity to improve the cumbersome online payment experience not just for entrepreneurs, but also for web developers and customers. Stripe lets business owners set up an online payment system and start accepting payments in as little as 10 minutes, with a process that’s as simple as embedding a line of code.

Cutting Red Tape

To fully understand how freeing this is for business owners and web developers, consider how limited online payment processing used to be.

Traditionally e-commerce companies accepted payments online by connecting with third-party software such as PayPal, or by spending time and money setting up a merchant account and building a network for securely storing sensitive credit card information. While larger companies with teams of developers could do this, smaller companies were limited in their options.

Furthermore, setting up a merchant account required an arduous waiting period – sometimes even months – before approval could be granted and payments could be accepted. Once payments were processed, they were subject to days-long holding periods while they were put through various levels of regulatory bureaucracy.

How Stripe Works

Stripe is a PSP (Payment Service Provider) that lets business owners collect payments, including recurring payments, and transfer them directly to their own account instantly. It does this by eliminating the need to store credit card information, which is what limited business owners before. Previously, when setting up an internal online payment system, web developers had to adhere to strict regulations surrounding the storing of credit card information, as per the Payment Card Industry’s Data Security Standard (PCI DSS). This is a complicated process that often requires a lot of paperwork and costly third-party consultation. While any business or individual merchant collecting or handling credit card information is still required to maintain PCI-compliance, Stripe takes care of a lot of the legwork. Customers can enter their credit card information, which goes directly to Stripe’s secure servers, so site owners don’t have to store sensitive user data. Stripe processes the payment, checks for fraud, and takes a fee of 2.9% plus 30 cents. Business owners see the money in their bank account instantly, rather than having to wait days for clearance. To customers, the payment experience is much the same, but faster and without the need to leave a current web page to visit a third-party page – as is the case with PayPal.

The Stripe Ecosystem

Perhaps one of the most unique aspects of Stripe is the ease with which web developers can build their own integrations that can merge with Stripe’s technology to fulfill other business requirements. In many ways Stripe is like a giant lock into which web developers can insert their own custom-built “key”, unlocking a payment process that’s tailored to e-commerce. This has created a third-party integration ecosystem that spans nearly every aspect of running a business, from analytics to accounting, email, expenses, and shipping processes. The best part? The massive Stripe ecosystem is accessible to anyone who uses the platform to run their online payment processing, and it truly allows developers and entrepreneurs to better serve their customers.

Big Players are Switching to Stripe

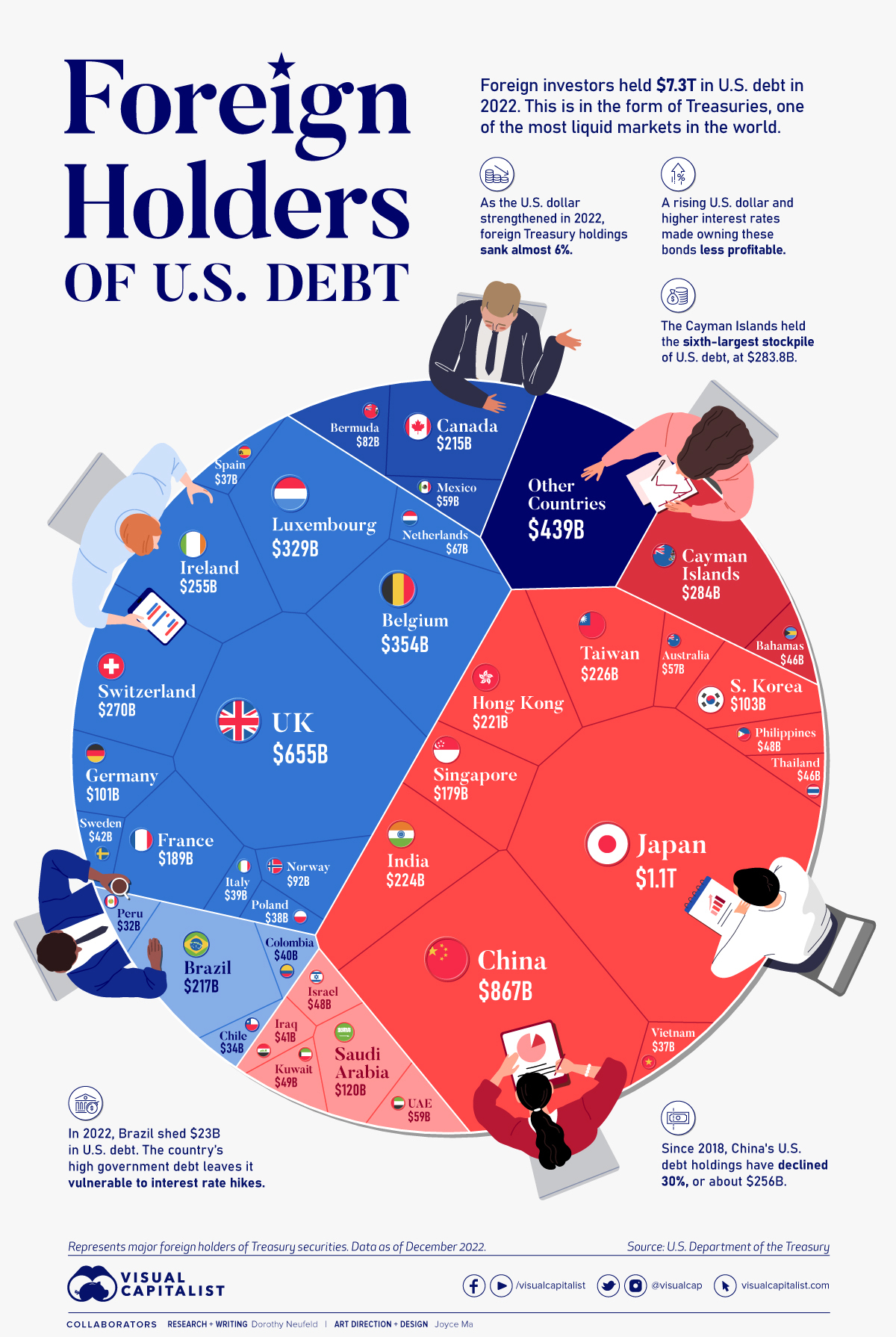

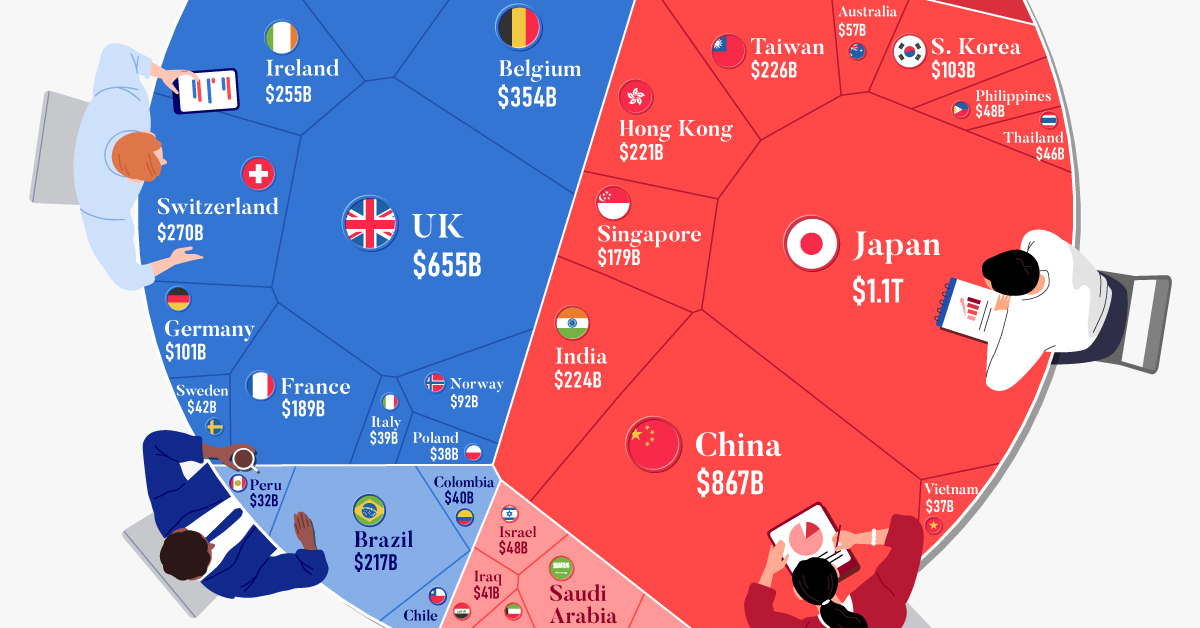

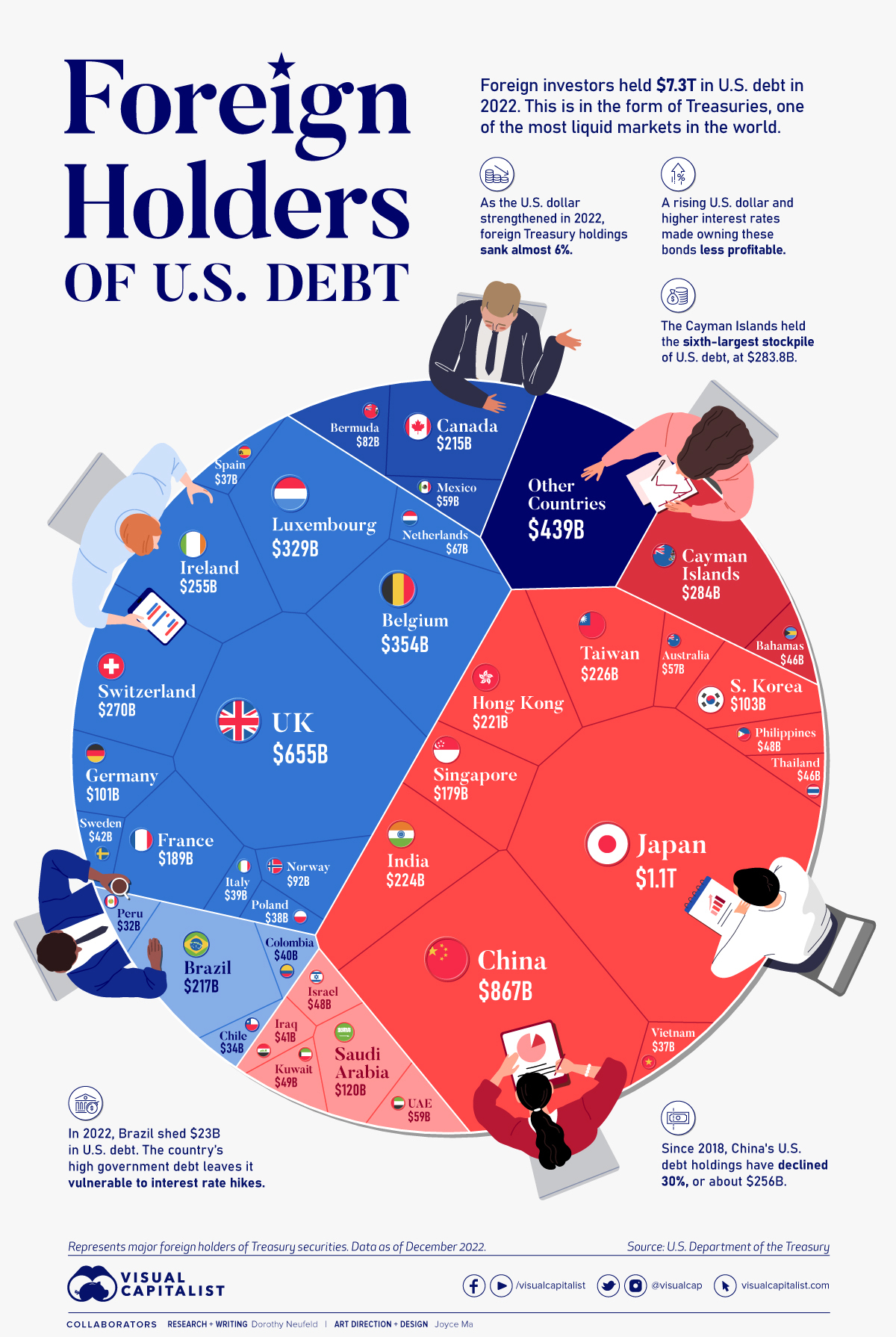

While Stripe was created with small business owners and startups in mind, recently some very big fish have joined forces with the payment processing platform, including Facebook, Lyft, Slack, Macy’s, and Target. With users in 110 countries and a recent foray into Asia, Stripe is now considered PayPal’s main competitor. It’s no surprise then, that PayPal alumni saw Stripe’s potential early on. That’s why PayPal co-founders Elon Musk, Peter Thiel, and Max Levchin have all invested in the now $9 billion payment startup. on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

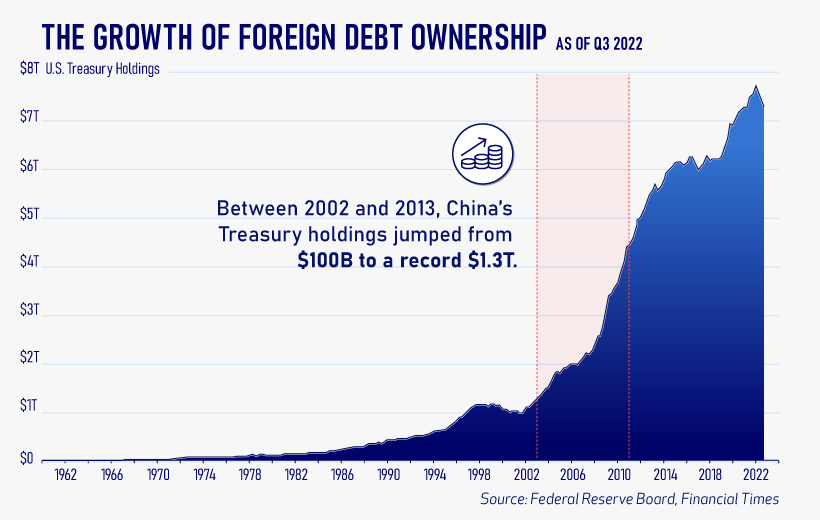

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.