Around this time, Bloomberg had an article titled “Oil Topping $116 Seen Possible as Iraq Conflict Widens” while even Investopedia forecasted on June 19, 2014 that oil prices could “hit $118.75” in the coming weeks. Forecasting is hard, and that’s why we don’t usually do it. In this case, oil prices stunned many investors by dropping off a cliff, tumbling to less than $50/bbl close to six months later. As Warren Buffett says, many people were caught swimming naked when the tide of high oil prices went out.

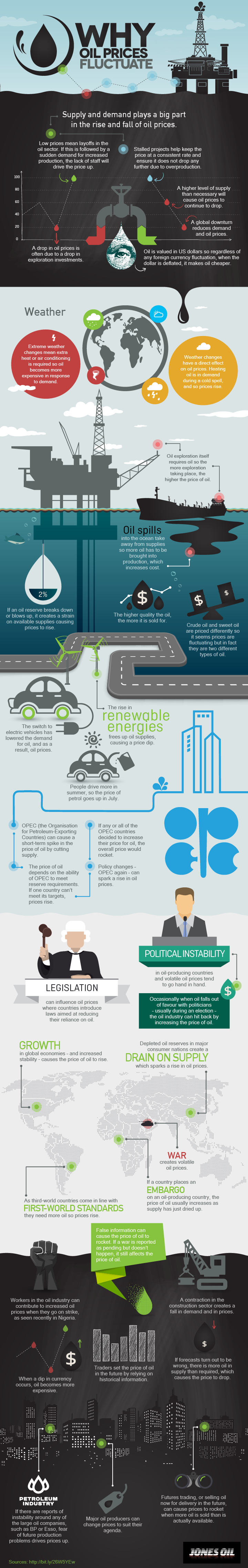

Understanding Why Oil Prices Fluctuate

To avoid being caught in a similar situation in the future, it helps to understand why and how oil prices fluctuate. Today’s infographic from Jones Oil is here to help us understand the many different issues that can impact global oil prices. It covers supply and demand, weather, technology, geopolitics, as well as other factors that make oil prices fluctuate.

Ultimately, oil prices fluctuate because of changes to supply and demand, but the challenge for investors is that there are multiple factors at play that can affect those fundamentals. Many of them are interconnected. These include weather events, supply interruptions (such as worker strikes or spills), broader demand trends such as the emergence of renewable energy, OPEC decisions, or other events that can have an immediate effect on supplies. There are also meta factors, such as the “fear” that a future event may happen that could in turn affect supply and demand. This is where geopolitical risks get priced in, such as potential escalation of conflict in the Middle East or future election results of oil exporting nations. Information and forecasts can also play a role. Imagine being an oil producer in early 2014, hearing some of the bullish reports above. Would you, or would you not invest in a project that had a breakeven of $60/bbl oil? Even a significant oil price fluctuation of +/- 30% would still have you come out on top. However, as in the situation in 2014, this would have actually increased margin production, which would have only added to the glut in supply.

on

#1: High Reliability

Nuclear power plants run 24/7 and are the most reliable source of sustainable energy. Nuclear electricity generation remains steady around the clock throughout the day, week, and year. Meanwhile, daily solar generation peaks in the afternoon when electricity demand is usually lower, and wind generation depends on wind speeds.As the use of variable solar and wind power increases globally, nuclear offers a stable and reliable backbone for a clean electricity grid.

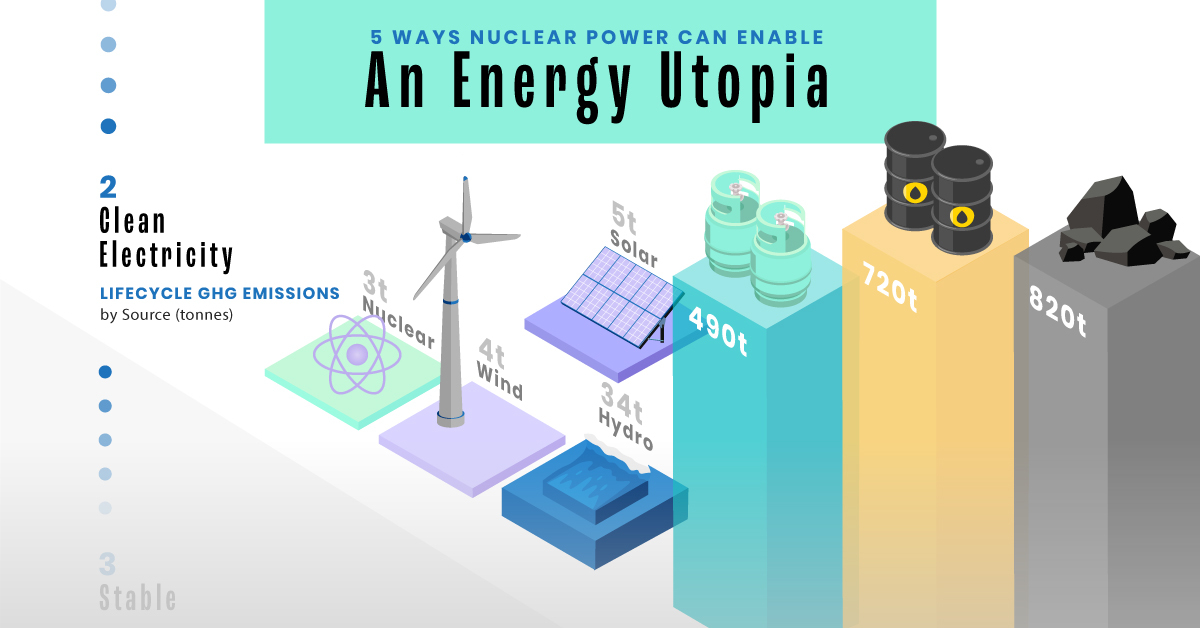

#2: Clean Electricity

Nuclear reactors use fission to generate electricity without any greenhouse gas (GHG) emissions.Consequently, nuclear power is the cleanest energy source on a lifecycle basis, measured in CO2-equivalent emissions per gigawatt-hour (GWh) of electricity produced by a power plant over its lifetime. The lifecycle emissions from a typical nuclear power plant are 273 times lower than coal and 163 times lower than natural gas. Furthermore, nuclear is relatively less resource-intensive, allowing for lower supply chain emissions than wind and solar plants.

#3: Stable Affordability

Although nuclear plants can be expensive to build, they are cost-competitive in the long run. Most nuclear plants have an initial lifetime of around 40 years, after which they can continue operating with approved lifetime extensions. Nuclear plants with lifetime extensions are the cheapest sources of electricity in the United States, and 88 of the country’s 92 reactors have received approvals for 20-year extensions. Additionally, according to the World Nuclear Association, nuclear plants are relatively less susceptible to fuel price volatility than natural gas plants, allowing for stable costs of electricity generation.

#4: Energy Efficiency

Nuclear’s high energy return on investment (EROI) exemplifies its exceptional efficiency. EROI measures how many units of energy are returned for every unit invested in building and running a power plant, over its lifetime. According to a 2018 study by Weissbach et al., nuclear’s EROI is 75 units, making it the most efficient energy source by some distance, with hydropower ranking second at 35 units.

#5: Sustainable Innovation

New, advanced reactor designs are bypassing many of the difficulties faced by traditional nuclear plants, making nuclear power more accessible.

Small Modular Reactors (SMRs) are much smaller than conventional reactors and are modular—meaning that their components can be transported and assembled in different locations. Microreactors are smaller than SMRs and are designed to provide electricity in remote and small market areas. They can also serve as backup power sources during emergencies.

These reactor designs offer several advantages, including lower initial capital costs, portability, and increased scalability.

A Nuclear-Powered Future

Nuclear power is making a remarkable comeback as countries work to achieve climate goals and ultimately, a state of energy utopia. Besides the 423 reactors in operation worldwide, another 56 reactors are under construction, and at least 69 more are planned for construction. Some nations, like Japan, have also reversed their attitudes toward nuclear power, embracing it as a clean and reliable energy source for the future. CanAlaska is a leading exploration company in the Athabasca Basin, the Earth’s richest uranium depository. Click here to learn more now. In part 3 of the Road to Energy Utopia series, we explore the unique properties of uranium, the fuel that powers nuclear reactors.