If you’re putting money in offshore bank accounts in order to save on taxes, there are two main criteria you’re looking for: secrecy and accessibility. Based on pop culture and media reports, you might imagine a secretive bank in Switzerland or a tiny island nation in the Caribbean. And though there is some truth to that logic, the reality is that the world’s biggest tax havens are spread all over the world. Some of them are small nations as expected, but others are major economic powers that might be surprising. Here are the world’s top 20 tax havens, as ranked by the 2020 Financial Secrecy Index (FSI) by the English NGO Tax Justice Network.

Which Countries are the Biggest Tax Havens?

The FSI ranks countries and territories from all over the world on two criteria: secrecy and scale.

Secrecy Score: How well the jurisdiction’s banking system can hide money. This includes analysis of ownership registration, legal entity transparency, tax and financial regulations, and cooperation with international standards. Global Scale Weight: What is the jurisdiction’s share of the world’s total cross-border financial services? This metric is based primarily on the IMF’s Balance of Payments statistics.

By weighing a country’s ability to hide money by its relative share of offshore financial services, we see the tax havens with the biggest impact on the global economy. At a glance, the top 20 tax havens are spread out across regions. Just under half of the list is located in Europe, but the rest are spread out across the Americas and Asia. And the jurisdictions are opposites in many ways. They include financial powerhouses like the U.S., Japan, and the UK as well as smaller nations and territories like the Cayman Islands, Hong Kong, and Luxembourg. But one surprising thing many of them have in common is a link to England. In addition to the UK, four of the top 20 tax havens—Cayman Islands, British Virgin Islands, Guernsey, and Jersey—are British Overseas Territories or Crown Dependencies. Also worth noting is the importance of scale in the rankings. The highest ranking jurisdictions by secrecy score were actually the Maldives, Angola and Algeria, but they represent less than 0.1% of total offshore financial services.

Best Place To Hide Private Vs. Corporate Tax

Some of the listed tax havens might be confusing to nationals of those countries, but that’s where relativity is important. The U.S. and Canada might not be tax havens for American or Canadian nationals, but the ultra-wealthy from East Asia and the Middle East are reported to utilize them due to holes in foreign tax laws. Likewise, the UAE has reportedly become a tax haven for Africa’s ultra-wealthy. In addition, many of the countries used as tax havens for individual wealth are also utilized by corporations. The Tax Justice Network’s 2021 assessment of corporate tax havens listed the British Virgin Islands, Cayman Islands, and Bermuda as the top three tax corporate tax havens. While individuals might create shell companies in tax havens to hide their wealth, corporations are usually directly incorporated in the tax haven in order to defer taxes. But the tax haven landscape might soon shift. The G7 struck a deal in June 2021 to start taxing multinational corporations based on the revenue generated in each country (instead of where the company is based), as well as setting a global minimum tax of 15%. In total, a group of 130 countries have agreed to the deal, including India, China, the UK, and the Cayman Islands. As the campaign to bring back deferred taxes ramps up, the question becomes one of response. Will the ultra-wealthy individuals and corporations start to work in tandem with the new rules, or discover new workarounds and tax havens? on Even while political regimes across these countries have changed over time, they’ve largely followed a few different types of governance. Today, every country can ultimately be classified into just nine broad forms of government systems. This map by Truman Du uses information from Wikipedia to map the government systems that rule the world today.

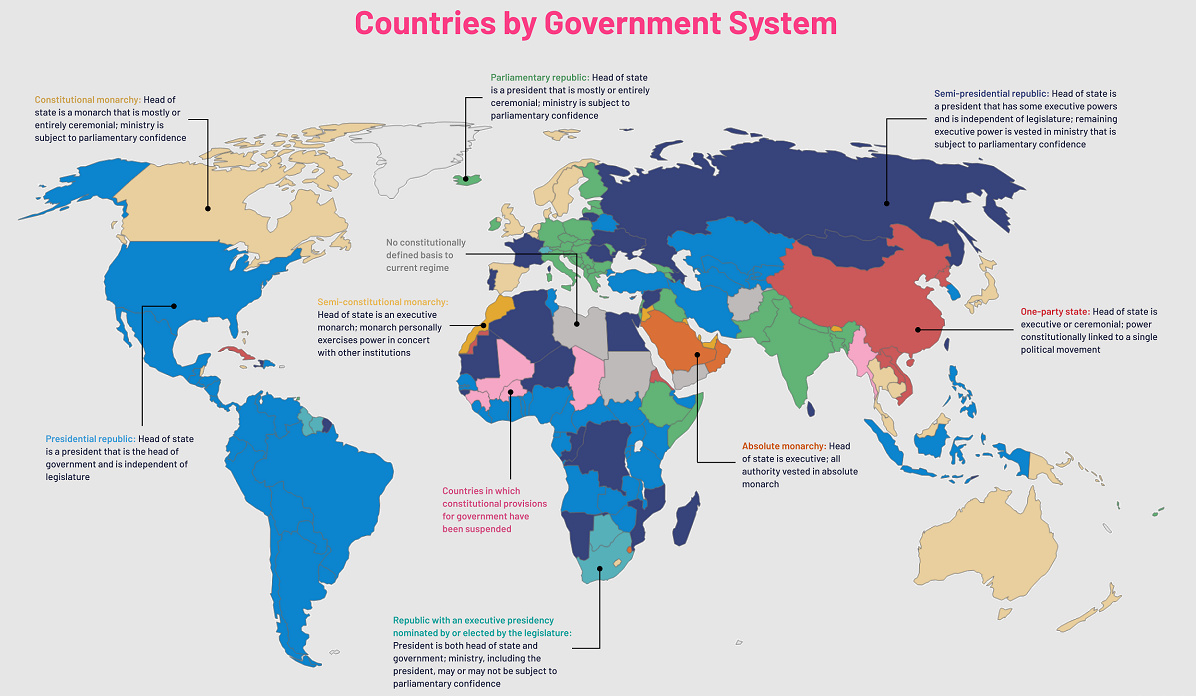

Countries By Type of Government

It’s important to note that this map charts government systems according to each country’s legal framework. Many countries have constitutions stating their de jure or legally recognized system of government, but their de facto or realized form of governance may be quite different. Here is a list of the stated government system of UN member states and observers as of January 2023: Let’s take a closer look at some of these systems.

Monarchies

Brought back into the spotlight after the death of Queen Elizabeth II of England in September 2022, this form of government has a single ruler. They carry titles from king and queen to sultan or emperor, and their government systems can be further divided into three modern types: constitutional, semi-constitutional, and absolute. A constitutional monarchy sees the monarch act as head of state within the parameters of a constitution, giving them little to no real power. For example, King Charles III is the head of 15 Commonwealth nations including Canada and Australia. However, each has their own head of government. On the other hand, a semi-constitutional monarchy lets the monarch or ruling royal family retain substantial political powers, as is the case in Jordan and Morocco. However, their monarchs still rule the country according to a democratic constitution and in concert with other institutions. Finally, an absolute monarchy is most like the monarchies of old, where the ruler has full power over governance, with modern examples including Saudi Arabia and Vatican City.

Republics

Unlike monarchies, the people hold the power in a republic government system, directly electing representatives to form government. Again, there are multiple types of modern republic governments: presidential, semi-presidential, and parliamentary. The presidential republic could be considered a direct progression from monarchies. This system has a strong and independent chief executive with extensive powers when it comes to domestic affairs and foreign policy. An example of this is the United States, where the President is both the head of state and the head of government. In a semi-presidential republic, the president is the head of state and has some executive powers that are independent of the legislature. However, the prime minister (or chancellor or equivalent title) is the head of government, responsible to the legislature along with the cabinet. Russia is a classic example of this type of government. The last type of republic system is parliamentary. In this system, the president is a figurehead, while the head of government holds real power and is validated by and accountable to the parliament. This type of system can be seen in Germany, Italy, and India and is akin to constitutional monarchies. It’s also important to point out that some parliamentary republic systems operate slightly differently. For example in South Africa, the president is both the head of state and government, but is elected directly by the legislature. This leaves them (and their ministries) potentially subject to parliamentary confidence.

One-Party State

Many of the systems above involve multiple political parties vying to rule and govern their respective countries. In a one-party state, also called a single-party state or single-party system, only one political party has the right to form government. All other political parties are either outlawed or only allowed limited participation in elections. In this system, a country’s head of state and head of government can be executive or ceremonial but political power is constitutionally linked to a single political movement. China is the most well-known example of this government system, with the General Secretary of the Communist Party of China ruling as the de facto leader since 1989.

Provisional

The final form of government is a provisional government formed as an interim or transitional government. In this system, an emergency governmental body is created to manage political transitions after the collapse of a government, or when a new state is formed. Often these evolve into fully constitutionalized systems, but sometimes they hold power for longer than expected. Some examples of countries that are considered provisional include Libya, Burkina Faso, and Chad.