Milk production in the U.S. has increased by a whopping 50% over that time frame—yet, the total number of dairy farms has dropped by three-quarters. Fewer and larger farms now have the lion’s share of all U.S milk cow inventory. While they have the ability to produce more competitively priced dairy products and provide more value to consumers, it is causing financial devastation for small farmers. The graphic above uses data from the USDA to chart the rapid consolidation of the American dairy industry between 1992 and 2017.

The End of the Small Dairy Farmer?

In the U.S., the dairy industry is one of the fastest consolidating industries in comparison to almost all other agricultural sectors. Between 1992 and 2017, small commercial farms with 10-99 cows saw an average decline of 70%. These farms accounted for 48.5% share of all U.S. milk cows in 1992. In 2017, that number stood at just 12.2%. Over time, small farm production has been replaced by that of bigger and more consolidated “megafarms”—a move that can be attributed to the many benefits that scale brings, such as lower costs of production and the potential to compete in the international market.

The Need For a Survival Strategy

While small dairy farmers simply cannot keep up with larger farms encroaching on their turf, they also have fluctuations in dairy prices to contend with. Milk prices fell in 2018, narrowing the gap between milk prices and feed costs so much that another wave of farm closures ensued. To make matters worse, many small dairy farmers are close to retirement age, and according to the USDA, exits are more likely if the farm operator is 60 or older. Despite the hardship facing small dairy farmers, analysts suggest that consumer backlash against large-scale production could present opportunities for small dairy farmers to create premium artisanal products. However, such initiatives would be entirely dependent on the state of the economy and where consumer’s values lie.

The Wider Implications

With milk production shifting to larger farms, a range of both direct and indirect impacts are being felt across the country. For example, milk production is now predominantly focused in fewer states such as California and Wisconsin, which together accounted for almost 33% of all U.S. milk production in 2018. In larger farms, the herds are typically confined to tight spaces— rather than grazing in pastures—making animal welfare an issue for many of these farms. Concern over waste contamination and air pollution also brings the environmental sustainability of larger farms into question as they come under more pressure to reduce their impact on the planet.

Changing Tastes

Looking beyond the production of milk, changing consumer preferences could result in the most transformative effects on both large and small scale dairy farmers. While rising populations are increasing the demand for dairy, per capita milk consumption declined by 24% between 2000 and 2017 in the United States. Consequently, the largest dairy producer in the country, Dean Foods, filed for bankruptcy in 2019, followed by another major milk producer, Borden Dairy, just two months later. Experts claim that changing consumer preferences, along with competition from other beverage categories, are responsible for 90% of the total dairy decline.

No Country for Old Farms

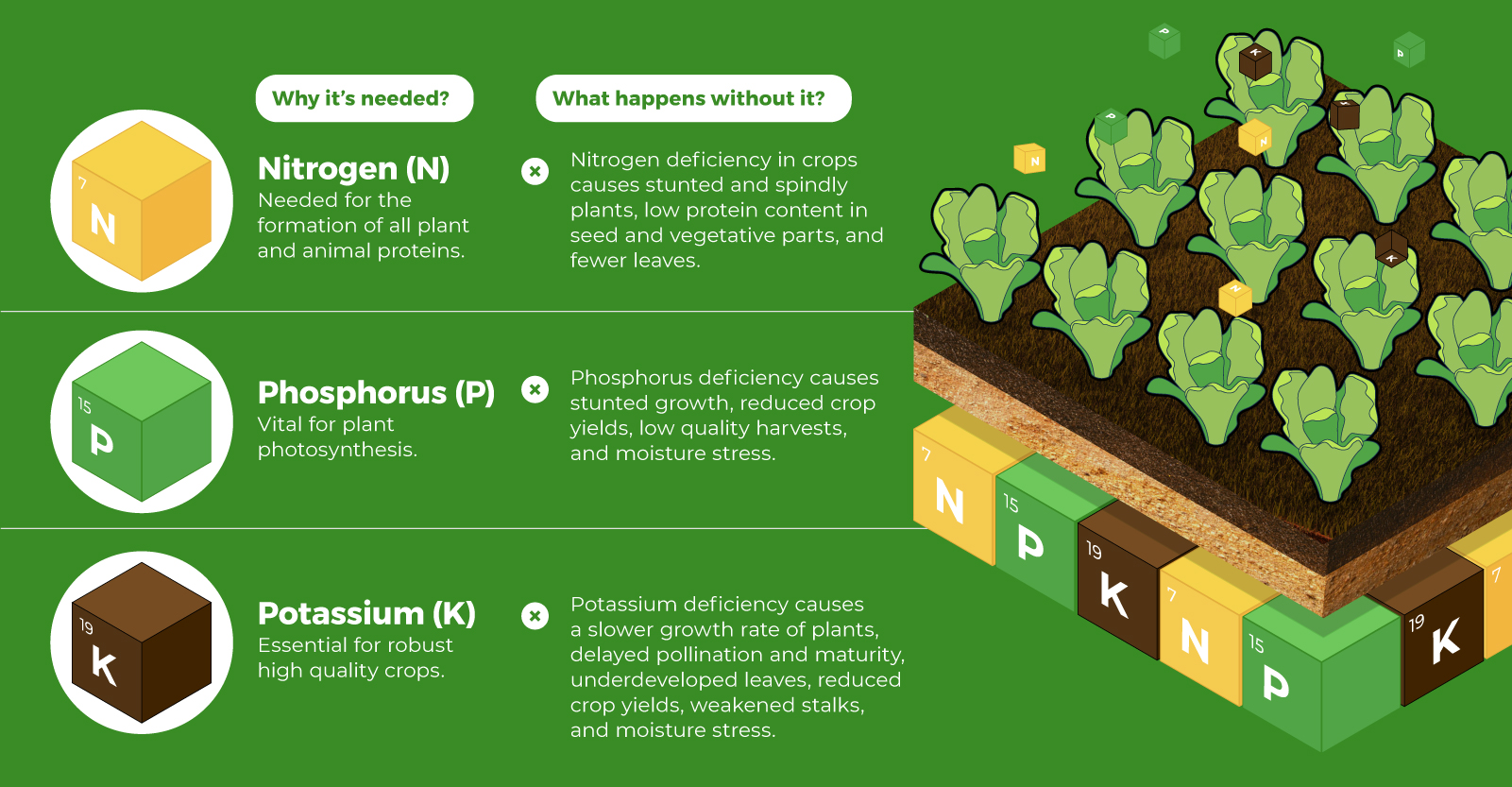

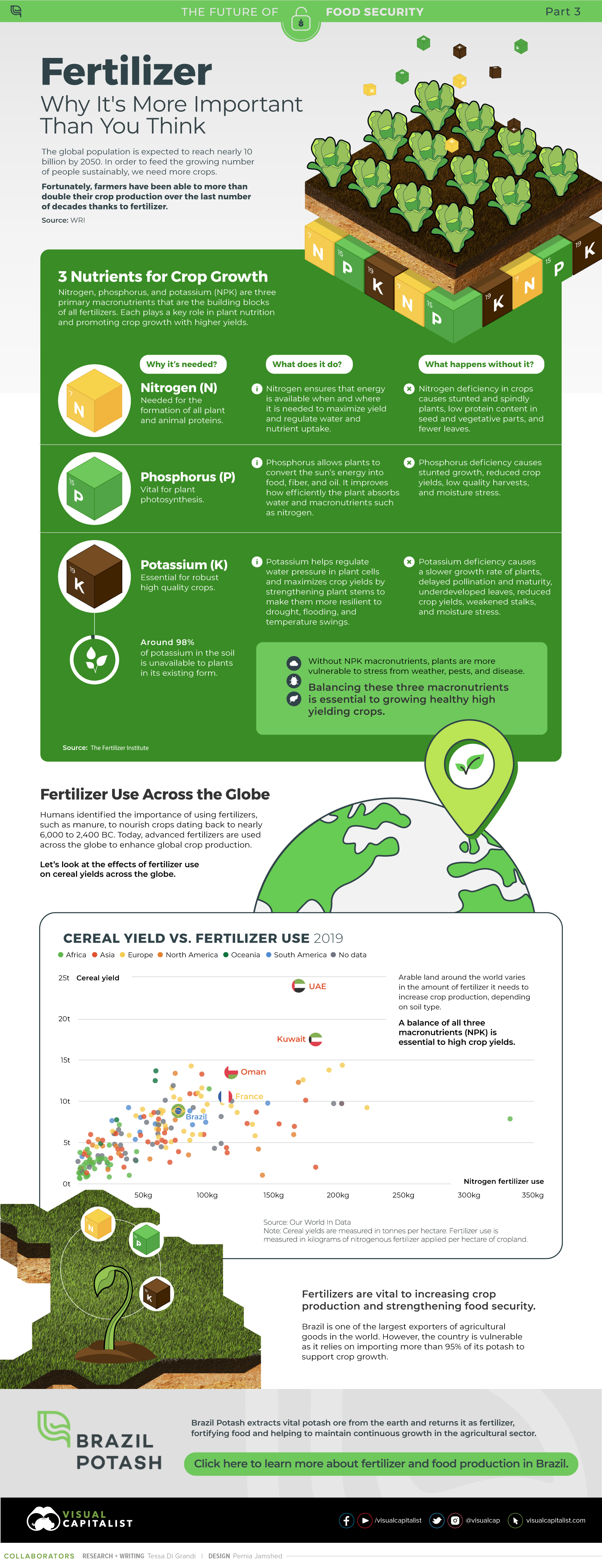

The confluence of changing economics and an aging population of farmers has brought the U.S. dairy farming industry to a tipping point, and the near future is likely to bring a fresh wave of dairy farm closures. – Joe Schroeder, Farm Aid As smaller farms continue to disappear from America’s rural landscape, the impacts of consolidation will not only affect dairy farmers, but entire rural communities too. on Over recent decades, farmers have been able to more than double their production of crops thanks to fertilizers and the vital nutrients they contain. When crops are harvested, the essential nutrients are taken away with them to the dining table, resulting in the depletion of these nutrients in the soil. To replenish these nutrients, fertilizers are needed, and the cycle continues. The above infographic by Brazil Potash shows the role that each macronutrient plays in growing healthy, high-yielding crops.

Food for Growth

Nitrogen, phosphorus, and potassium (NPK) are three primary macronutrients that are the building blocks of the global fertilizer industry. Each plays a key role in plant nutrition and promoting crop growth with higher yields. Let’s take a look at how each macronutrient affects plant growth. If crops lack NPK macronutrients, they become vulnerable to various stresses caused by weather conditions, pests, and diseases. Therefore, it is crucial to maintain a balance of all three macronutrients for the production of healthy, high-yielding crops.

The Importance of Fertilizers

Humans identified the importance of using fertilizers, such as manure, to nourish crops dating back to nearly 6,000 to 2,400 BC. As agriculture became more intensive and large-scale, farmers began to experiment with different types of fertilizers. Today advanced chemical fertilizers are used across the globe to enhance global crop production. There are a myriad of factors that affect soil type, and so the farmable land must have a healthy balance of all three macronutrients to support high-yielding, healthy crops. Consequently, arable land around the world varies in the amount and type of fertilizer it needs. Fertilizers play an integral role in strengthening food security, and a supply of locally available fertilizer is needed in supporting global food systems in an ever-growing world. Brazil is one of the largest exporters of agricultural goods in the world. However, the country is vulnerable as it relies on importing more than 95% of its potash to support crop growth. Brazil Potash is developing a new potash project in Brazil to ensure a stable domestic source of this nutrient-rich fertilizer critical for global food security. Click here to learn more about fertilizer and food production in Brazil.