In the modern era, data and media are the new magic 8-ball. The jury is still out on whether we’ve gotten any better at anticipating the forces that will shape the coming year, but that certainly hasn’t stopped people from trying. Of the hundreds of forward-looking pieces of content published in the lead-up to 2020, how many of the expert predictions lined up? Was there a consensus on any particular trend, or were predictions all over the map? During the month of December we analyzed over 100 articles, whitepapers, and interviews to answer that question. While there was no firm consensus on where 2020 will take us, there were a few themes that appeared in multiple publications. Today’s graphic highlights these reappearing predictions, and below, we examine seven of them in more detail.

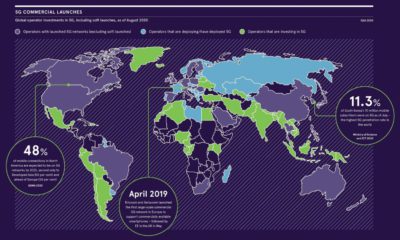

The Promise and Controversy of 5G

One technology that’s sure to capture the headlines in 2020 is 5G. Broadband speeds of over one gigabit per second will become a reality when 5G technology rolls out across the country, without the cable that currently connects most homes. This prediction is a slam dunk, as some carriers are already testing the technology in select neighborhoods around the United States.

Experts also predict that a wave of 5G-enabled smartphone and IoT products will become commercially available in 2020. The wild card in this 5G story will be guessing which companies end up building out the new network. Huawei was in a strong position to lead the charge, but the company has been stonewalled in a number countries – most notably the United States, Australia, and Japan. Whether due to national security concerns or protectionism, Chinese companies may continue to face an uphill battle in Western markets.

Fake News 2.0

While many predictions for 2020 were fueled by excitement for new technologies, there was one that was decidedly more ominous – the proliferation of deepfakes. Simply put, deepfakes are videos that harness artificial intelligence to create a convincing likeness of a real person.

With the U.S. presidential election just around the corner, many experts fear that deepfakes are going to do serious damage, manipulating public opinion on both sides of the political spectrum. Unlike fake news, which often comes with obvious visual cues to help determine authenticity, even deepfakes created using free online tools are extremely convincing. If predictions come true, the lead-up to the U.S. election could be a wild ride.

Consumerism in Flux

The Cookie Begins to Crumble

In 2019, approximately $330 billion was spent on digital advertising, but privacy regulations such as GDPR and the CCPA – California’s new privacy law – are causing massive disruption and upheaval in this industry. For many years, the humble internet cookie has done the heavy lifting in collecting your personal data from online activity. This data is what advertisers use to reach you as you scroll Instagram or read articles online. Already, changes to Safari and Firefox wiped out about 40% of all third-party cookies, and in a world where people need to physically click a button on each site to allow cookies, it’s unclear how viable the technology will be as privacy measures are enacted.

The Call of the Picket Fence

One of main predictions going into 2020 is that starter homes will be a leading category in new home builds. For millions of millennials around the country in the rental market, a starter home – the first residence a person or family can afford to purchase, often using a combination of savings and mortgage financing – will begin to look more appealing. Rent in American cities has been marching upward for nearly a decade, and the promise of more space and entry into the home ownership market may lure more of this generational cohort to the suburbs.

Also on the topic of real estate, a few experts noted that even if there is an economic downturn in 2020, the housing market is unlikely to take a big hit.

All Eyes on IPOs

Despite experiencing a rough patch in 2019, SoftBank and its gargantuan Vision Fund will remain one of the most powerful forces in Silicon Valley this year. Masayoshi Son, Softbank’s enigmatic CEO, appears to have adopted a more pragmatic approach, citing a company’s “ability to turn a profit in the future” as a yardstick of evaluating the value of an investment. Experts predict that in light of the very public PR disasters of unicorns Uber and WeWork, investors will be much more skeptical of high-valuation IPOs.

In 2020, more companies are predicted to opt for a direct listing to go public.

What Goes Up?

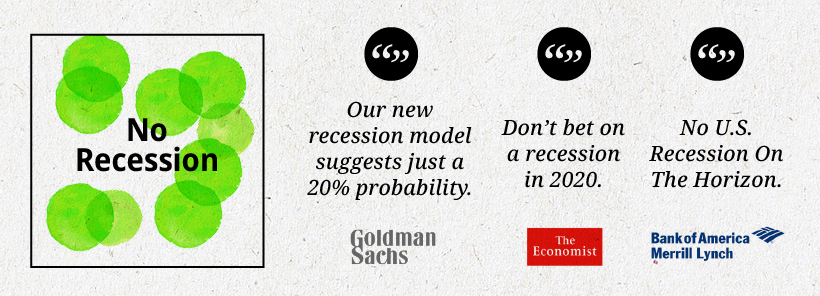

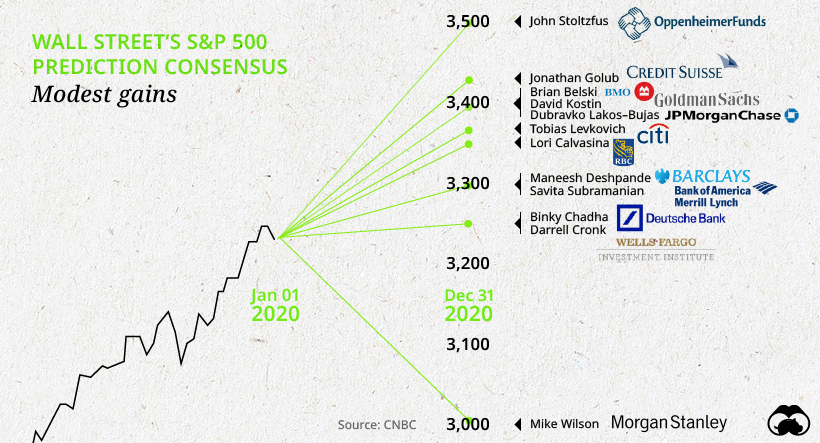

When the ball dropped to usher in 2019, market sentiment was leaning toward an impending recession. A year later, the economic expansion is still underway, and many experts now have a more positive outlook for 2020.

The majority of predictions we analyzed foresaw a year of continued job growth and modest gains in the stock market. Here’s a look at S&P 500 end target predictions from some of Wall Street’s top strategists:

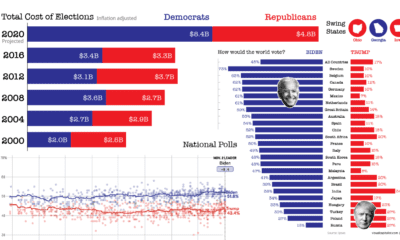

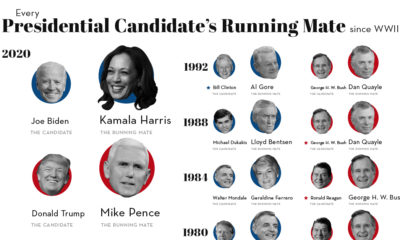

The Elephant in the Oval

One prediction nobody seemed particularly keen to make was on the result of the impending U.S. presidential election. Experts are likely happy to take a wait-and-see approach until the Democratic nominee is announced. Also looming in the back of people’s minds might be the memory of 2016, which was a powerful reminder that even predictions that seem like a sure thing don’t always pan out as expected. – Peter Lynch A note on methodology: To make sure we captured a robust cross section of predictions for the coming year, we spent the month of December tracking down and analyzing hundreds of articles, whitepapers, and interviews from respected sources. For this exercise, we chose to focus on four broad, interconnected themes – the economy, consumerism, real estate, and technology. In the end, we analyzed 100+ published pieces, and captured 150+ predictions. We focused on content from media publications in Comscore’s top 100, major banks and consultancies, and brands and agencies with high-quality thought leadership. In the end, we highlighted the 25 predictions that appeared the most often. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

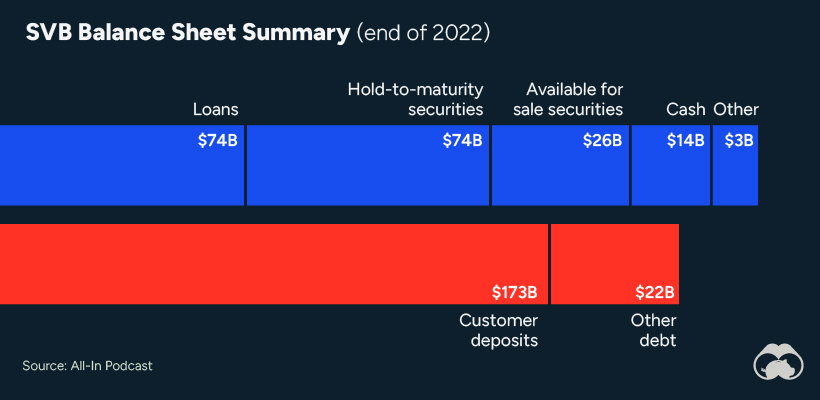

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

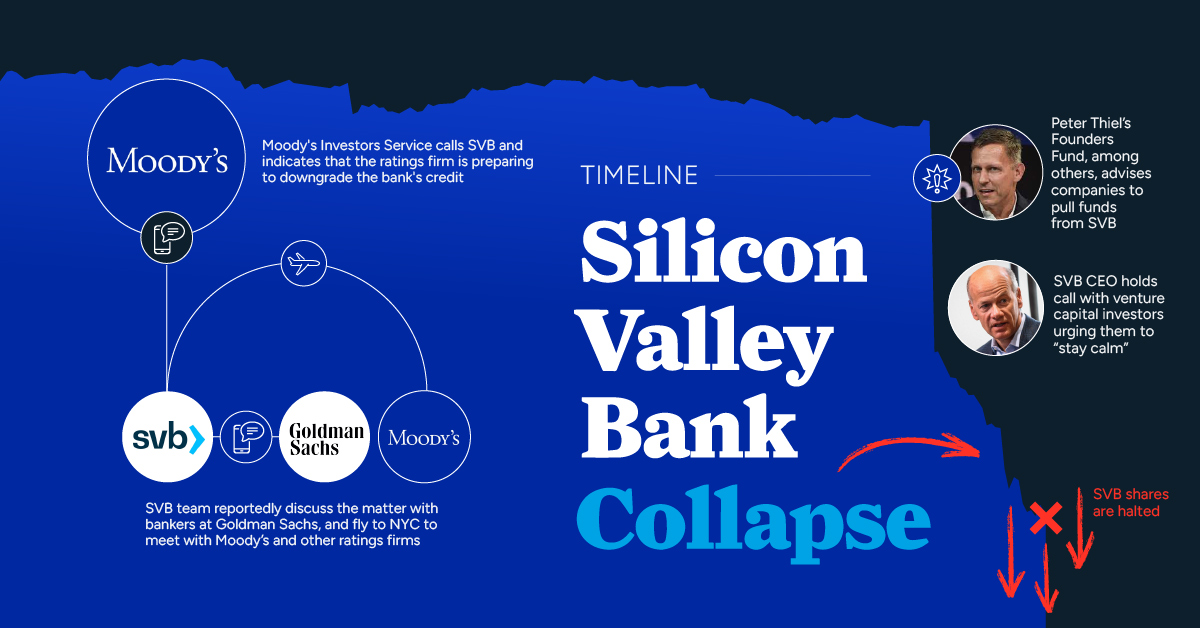

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.