These veteran billionaires are worth a collective $81.4 billion and have served in posts ranging from Reserve Officers’ Training Corps (ROTC) to infantrymen in the Second World War. This visual, using data from Forbes, ranks the richest living American veterans. This visual categorizes the individuals by either the military branch or war served in depending on what was applicable or determinable.

I Want You for the U.S. Army

According to the Department of Veteran’s Affairs, there are around 18 million veterans in the U.S. Of these 18 million, less than 0.01% can claim the title of billionaire. Six of the above veteran billionaires served in WWII. They are some of the last surviving veterans of the historic war which was fought by 16 million Americans—today, only around 325,000 WWII veterans are still alive. George Joseph, of Mercury Insurance Group, piloted a B17 Bomber plane in WWII, and completed around 50 missions. Warren Buffett’s business partner at Berkshire Hathaway, Charlie Munger, served in the Army Air Corps in the early 1940s. Richard Kinder (Kinder Morgan Inc.) and Fred Smith (FedEx) both served in the Vietnam war. One notable figure, Ralph Lauren, whose name is synonymous with his clothing products, served in the Army branch for two years in the early 1960s.

Taking on Financial Risk

Billionaire wealth continues to grow in America. Most of these veteran billionaires saw their net worths increase from 2020 to 2021, as, typically, wealth begets wealth. Here’s a look at the changes in net worth of the top five richest veterans who experienced increases:

Edward Johnson III: +$4.9 Billion Ralph Lauren: +$1.4 Billion Richard Kinder: +$1.8 Billion Charles Dolan & Family: +$1.5 Billion Fred Smith: +$3.0 Billion

The majority of these veteran billionaires are in the finance industry and some are tied to well-known companies, but they didn’t always have billions on hand to help them exponentially grow their fortunes. David Murdock was a high school dropout, and after serving in WWII, had no money to his name. He took over a failing company called Dole, and eventually gained the moniker of ‘pineapple king’ after reviving the business. S. Daniel Abraham, who was an infantryman in WWII, went on to found Thompson Medical. Their main product was Slimfast, which he later sold to Unilever for $2.3 billion in cash in the early 2000s. Bob Parsons, who received a Purple Heart for his service in Vietnam, started out his professional career as a CPA. He later founded the enormous domain giant, Go Daddy. He has claimed that his time in the military helped him succeed in business.

Peace and Prosperity

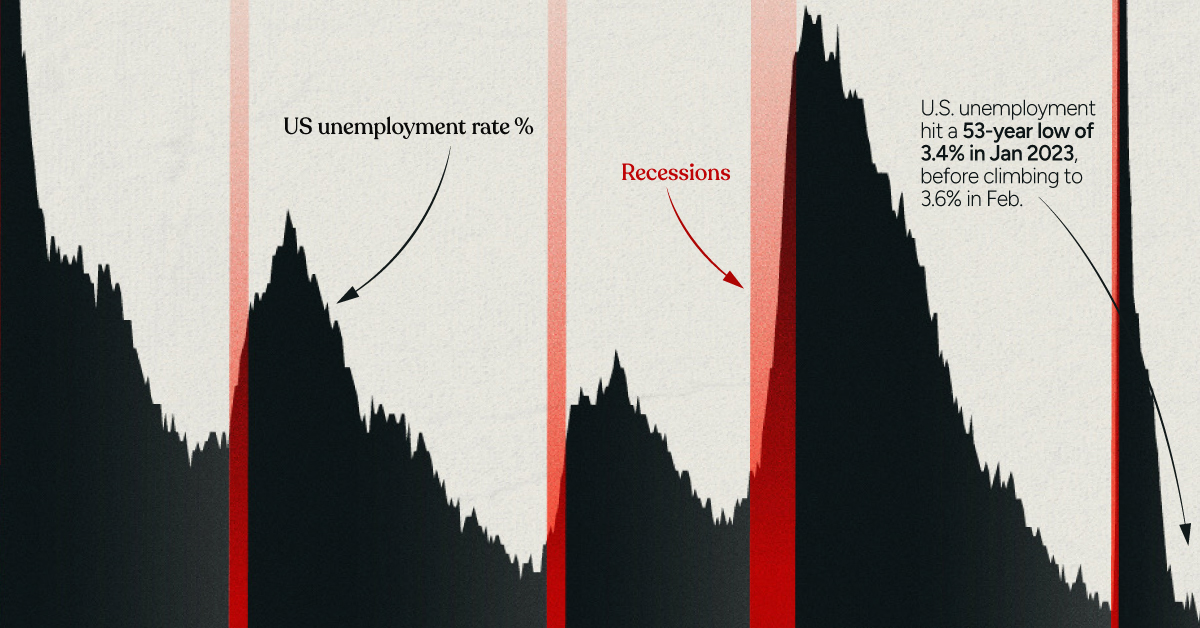

We currently live in one of the most peaceful and prosperous times in history, with wars like WWII feeling to many like a story from the past — but for others these conflicts were defining moments for their generation. While many veterans struggle to readjust to civilian life, on average pre-9/11 veterans have reported fewer difficulties compared to post-9/11 veterans, and some have even managed to reach the highest levels of financial success. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.