It is therefore no surprise that apps have become one of the largest consumer ecosystems on the planet, with the global app economy expected to reach $6.3 trillion by 2021. Today’s graphics pull data from a recent report by Sensor Tower that ranks the top 20 most downloaded apps of 2019. New entrants are rising up and threatening the dominance of more established tech companies—but can they sustain their current position on the leaderboard?

The Champions of the App Economy

According to the report, total app downloads grew to 115 billion in 2019, including almost 31 billion downloads on the App Store and 84 billion on Google Play. Social media giant Facebook owns four out of five of 2019’s most downloaded apps: Facebook, Facebook Messenger, WhatsApp, and Instagram. Collectively, they boast an eye-watering 16 billion downloads—with WhatsApp holding the top spot for the fourth year running. Growth in the short-form video category is apparent. The video creation app Likee joined this year’s ranking and sits in sixth place, with the majority of the app’s 330 million downloads coming from India. The app lets users edit videos using a wide variety of effects, and directly competes with TikTok—a lip syncing app that entered the ranking in 2018 and now threatens WhatsApp’s position at the top of the leaderboard.

Which Apps Are Climbing the Ranks?

TikTok is the newest platform to turn its users into viral sensations, grossing $177 million in 2019. This is equal to more than five times its 2018 revenue. TikTok also bypassed Instagram in 2018, breaking Facebook’s foothold on the top four apps globally.

TikTok is owned by Chinese tech firm ByteDance, the most valuable private company in the world—and 78% of TikTok’s total Q4’2019 revenue came from its native country. Aside from several short-form video entrants, new players from other industries continue to storm up the ranks. While they don’t make the list of most downloaded apps yet, their recent success could change that.

Streaming Services

Netflix is the only streaming service to make it into the top 20 most downloaded apps, but the launch of Disney+ could potentially change that. Despite a November launch, Disney+ became the second most popular new app of 2019. Within a month, the service generated $50 million in revenue.

Gaming

With 2.4 billion people playing mobile games in 2019, gaming is also set to become a major player in the app economy. Two popular console franchises, Call of Duty and Mario Kart, recently entered the mobile market to become two of the most successful games in the category. The free mobile version of Call of Duty had the second best quarter of any mobile game ever, with 170 million worldwide downloads. Only Pokémon GO had a better quarter, with more than 300 million installs when it launched in 2016. The success of these apps can be attributed to their already established consumer base, and the evident shift in more gamers moving to mobile platforms as smartphone technology and processing speeds improve.

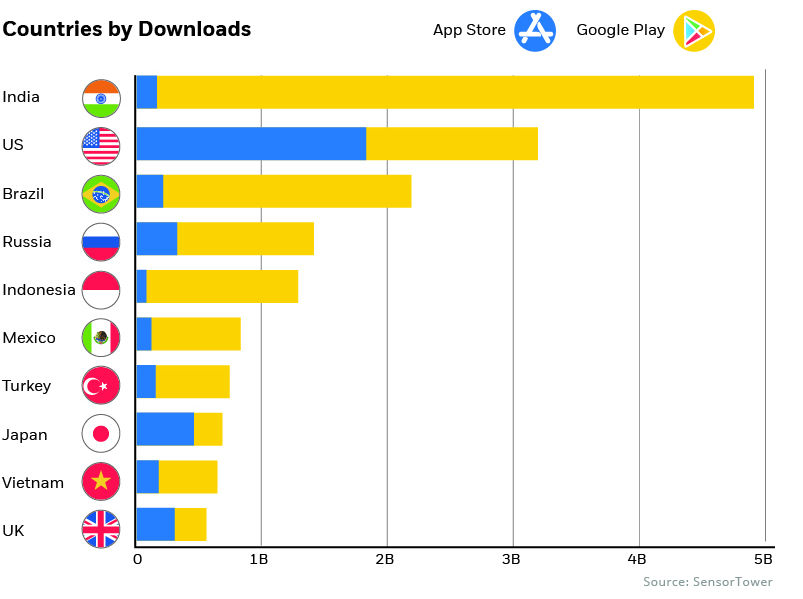

Countries Leading the App Economy

The app economy is also being fueled by growth in emerging markets including China, India, Brazil and Russia, thanks to faster internet speeds and increasing smartphone adoption rates. Specifically, India’s increasing digitization is driving significant growth in the market. The country witnessed nearly 5 billion app installs in the last quarter of 2019—surging ahead of the U.S. with just over 3 billion installs. Note: As Google Play is not available in China, the country was excluded from this chart. India’s demand could be attributed to the fact that half of its 1.3 billion population is under the age of 25. A younger, tech savvy audience has resulted in India becoming TikTok’s top market, commanding 45% of the app’s first time downloads in 2019.

The App Economy 2.0

With an explosion in user spending, and seemingly endless opportunities for innovation, the global app economy shows a tremendous amount of promise, but is still in its early days. —Danielle Levitas, EVP of Global Marketing & Market Insights at App Annie Rising consumer spend combined with other forms of monetization, such as advertising and mobile commerce, could soon enable the app market to surpass the trillion dollar barrier in revenue. While many experts claimed that the app industry was dead in its tracks, it’s safe to say that those predictions are now being irrefutably challenged. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.