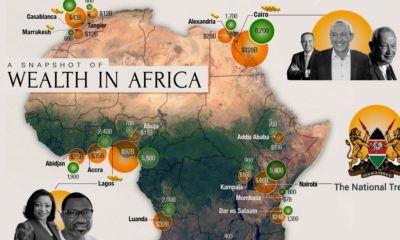

The number of wealthy individuals in Africa is growing, however. Total private wealth is expected to rise 30% over the next decade, led by growth in the billionaire and millionaire segments. Visualized here are Africa’s richest, using data collected by Forbes, on billionaires who reside on the continent and have their primary business there.

Breaking Down Africa’s Billionaires

The richest man in Africa is also the richest Black man in the world. Once a small sugar trader, Aliko Dangote now has a net worth of $13.5 billion. He is the 86th richest person in the world, and single-handedly makes up 25% of the total wealth of African billionaires. His company, the Dangote Group is now an African conglomerate with interests in a range of sectors, including sugar, cement, and real estate. The top three—Alike Dangote, Johann Rupert, and Nicky Oppenheimer—account for 40% of the total wealth of those ranked.

A Look Through the Rest of the Richest People in Africa

At number two on the list is Johann Rupert. The chairman of Swiss luxury goods company, Compagnie Financiere Richemont, started his career with a banking apprenticeship in New York, before returning to South Africa and eventually pivoting to retail. Through the rest of those ranked, a range of diverse business activities have allowed these billionaires to garner their wealth. Nicky Oppenheimer (3rd) and Patrice Motsepe (9th)—have made fortunes in the mining industry, a sector which contributes nearly 10% to sub-Saharan Africa’s GDP. Meanwhile, Naguib Sawiris (8th) and Strive Masiyiwa (12th) have built telecom empires.

Billionaire Wealth Mirrors Country Wealth

Only seven out of the 54 African countries are represented on Africa’s rich list, and even amongst them, three countries (Egypt, South Africa, and Nigeria) account for more than two-thirds of the top-ranked billionaires. The home countries for these billionaires reflects the nations’ contribution to the African economy as a whole. Nigeria, South Africa, and Egypt have the top three GDPs in Africa. Algeria—where Issad Rebrab (7th) is from—is ranked fourth, and Morocco—where Aziz Akhannouch (13th) is based—is fifth.

What’s Next For Africa’s Richest?

Africa has routinely been touted to become a future economic powerhouse as its demographic dividend pays off in the next few decades. However, its biggest challenge will be developing its economic and social infrastructure to retain local talent to make their fortunes at home. Source: Forbes. Data note: Forbes calculated net worths using stock prices and currency exchange rates from the close of business on Friday, January 13, 2023. For privately held businesses, they used estimates of revenues or profits and applied prevailing price-to-sale or price-to-earnings ratios for similar public companies. Some list members grew richer or poorer within weeks or days of their measurement date. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.