However, this view comes with the benefit of plenty of hindsight – and even Elon Musk would tell you that it wasn’t always obvious that the company would be around in 2017. There were periods of time when layoffs were rampant, the company’s payroll was covered by credit cards, and Tesla was on the brink of bankruptcy.

Rise of Tesla: The History (Part 1 of 3)

Today’s massive infographic comes to us from Global Energy Metals, and it is the first part of our three-part Rise of Tesla Series, which will soon be a definitive source for everything you ever wanted to know about the company. Part 1 deals with the origin story of the company, challenges faced by the first EVs, the company’s strategy and initial execution, and the Tesla Roadster’s development.

Tesla was initially conceived in 2003 out of the vision of two Silicon Valley engineers, Martin Eberhard and Marc Tarpenning. The partners had just sold their eReader company for $187 million, and were looking for their next big idea. The infamous “death” of GM’s EV1 electric car that year ended up being a source of inspiration, and the two engineers started looking into ways to reduce the world’s reliance on Middle Eastern oil and to combat climate change.

– Martin Eberhard, Tesla co-founder

The company was bootstrapped until Elon Musk led the $7.5 million Series A round in February 2004 and became the controlling investor. He joined the board of directors as its chairman, and took on operational roles as well. At this time, JB Straubel – who famously rebuilt an electric golf cart when he was only 14 years old – also joined the company as CTO.

Initial Strategy

Tesla’s initial strategy was to build a high performance sports car first, for a few reasons:

It would shed the existing stigma around EVs Sports cars have higher margins Fewer cars would need to be produced High-end buyers are less price-sensitive

Instead of building the Tesla Roadster from scratch, the company aimed to combine an existing chassis with an AC induction motor and battery. And so, the company signed a contract with British sports car maker Lotus to use its Elise chassis as a base.

Roadster Debut

The Roadster made its debut at a star-studded launch party in Santa Monica. The 350-strong guestlist of Hollywood celebrities and the press were wowed by the 2-seater sports car with a $100,000 price tag.

– The Washington Post

What the audience didn’t notice? The Roadsters had many issues that needed to be fixed – these and others would delay Tesla well beyond the planned Summer 2007 delivery date.

The Dark Years

Tesla’s original business plan was built on the idea that the auto industry had changed drastically. Automakers now focused on core competencies like financing, engine design, sales and marketing, and final assembly – getting the hundreds of individual car parts, like windshield wiper blades or door handles, was actually outsourced. This was supposed to make it easy for Tesla to get its foot in the door – to focus on the EV aspect and let Lotus do the rest. Instead, the company experienced an “elegance creep” phenomenon. They were able to keep making the car nicer, but it meant customizing individual parts. Costs spiraled out of control, things got delayed, and the car began to take a very different shape than the Elise. By the time it was said and done, the Tesla Roadster was nothing like its Lotus cousin, sharing only 7% parts by count.

The Revolving Door

During this process, there was a revolving door of CEOs. 2007: Eberhart was forced to resign as CEO in August 2007: Early Tesla investor Michael Marks took the reins temporarily 2007: In November, Ze’ev Drori took over as CEO and President 2008: After less than a year of Drori’s run, Musk stepped in to take over the role in October At this point, Musk had already invested $55 million in the company, and it was teetering towards bankruptcy.

– Elon Musk

Some of Musk’s first moves:

He ended up cutting 25% of the workforce He leaned on friends to help cover payroll, week-to-week He raised a $40 debt financing round to escape bankruptcy He formed a strategic partnership with Daimler AG, which acquired a 10% stake of Tesla for $50 million He took a $465 million loan from the U.S. Dept. of Energy (He repaid it back ahead of the deadline) He recalled 75% of the Roadsters produced between March 2008 and April 2009

Despite revamping the entire production process – and the company itself – Tesla made it through its most trying time.

The Roadster’s Run

The Roadster wasn’t perfect, but it helped Tesla learn what it meant to be a car company.

– Car and Driver

A total of 2,450 units were produced, and the specs were impressive for an EV. With a top speed of 125 mph and a 0-60 mph time of 3.7 seconds, the Roadster helped dispel many of the myths surrounding electric cars. Meanwhile, the Roadster’s lithium-ion battery also was the first step forward in an entire battery revolution. The 992 lb (450 kg) battery for the Roadster contained 6,831 lithium ion cells arranged into 11 “sheets” connected in series, and gave the car a range of 244 miles. With the Roadster, Tesla would not only set itself up for future success, but also the transformation of an entire industry. This was Part 1 of the Tesla Series. Parts 2 and 3, on Tesla as well as the future vision, will be released in the near future! on With the world gearing up for the electric vehicle era, battery manufacturing has become a priority for many nations, including the United States. However, having entered the race for batteries early, China is far and away in the lead. Using the data and projections behind BloombergNEF’s lithium-ion supply chain rankings, this infographic visualizes battery manufacturing capacity by country in 2022 and 2027p, highlighting the extent of China’s battery dominance.

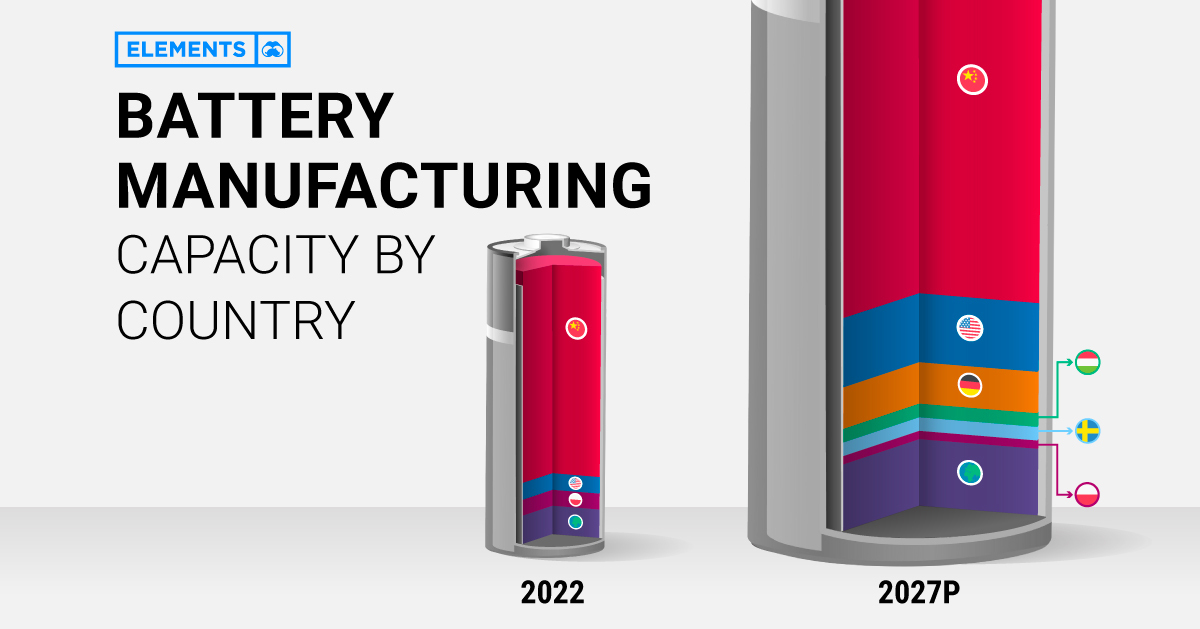

Battery Manufacturing Capacity by Country in 2022

In 2022, China had more battery production capacity than the rest of the world combined. With nearly 900 gigawatt-hours of manufacturing capacity or 77% of the global total, China is home to six of the world’s 10 biggest battery makers. Behind China’s battery dominance is its vertical integration across the rest of the EV supply chain, from mining the metals to producing the EVs. It’s also the largest EV market, accounting for 52% of global sales in 2021. Poland ranks second with less than one-tenth of China’s capacity. In addition, it hosts LG Energy Solution’s Wroclaw gigafactory, the largest of its kind in Europe and one of the largest in the world. Overall, European countries (including non-EU members) made up just 14% of global battery manufacturing capacity in 2022. Although it lives in China’s shadow when it comes to batteries, the U.S. is also among the world’s lithium-ion powerhouses. As of 2022, it had eight major operational battery factories, concentrated in the Midwest and the South.

China’s Near-Monopoly Continues Through 2027

Global lithium-ion manufacturing capacity is projected to increase eightfold in the next five years. Here are the top 10 countries by projected battery production capacity in 2027: China’s well-established advantage is set to continue through 2027, with 69% of the world’s battery manufacturing capacity. Meanwhile, the U.S. is projected to increase its capacity by more than 10-fold in the next five years. EV tax credits in the Inflation Reduction Act are likely to incentivize battery manufacturing by rewarding EVs made with domestic materials. Alongside Ford and General Motors, Asian companies including Toyota, SK Innovation, and LG Energy Solution have all announced investments in U.S. battery manufacturing in recent months. Europe will host six of the projected top 10 countries for battery production in 2027. Europe’s current and future battery plants come from a mix of domestic and foreign firms, including Germany’s Volkswagen, China’s CATL, and South Korea’s SK Innovation.

Can Countries Cut Ties With China?

Regardless of the growth in North America and Europe, China’s dominance is unmatched. Battery manufacturing is just one piece of the puzzle, albeit a major one. Most of the parts and metals that make up a battery—like battery-grade lithium, electrolytes, separators, cathodes, and anodes—are primarily made in China. Therefore, combating China’s dominance will be expensive. According to Bloomberg, the U.S. and Europe will have to invest $87 billion and $102 billion, respectively, to meet domestic battery demand with fully local supply chains by 2030.