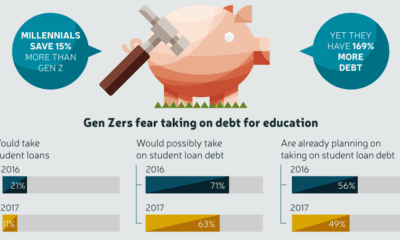

Everyone should have access to knowledge on how to save money, buy a home, make smart purchases, and build a robust portfolio of investments. This information can be dry at times, but it can also be the difference between being living month-to-month and achieving financial independence. Yet statistics show that only about 16.4% of high school grads were required to take a course on personal finance, and problems go far deeper than that. Right now, financial literacy is dropping around the globe – and even worse, a record-high amount of debt is weighing younger generations down.

Introducing Wealth 101

Today we’re proud to announce our partnership with U.S. non-profit Next Gen Personal Finance, which specializes in offering free personal finance resources for teachers and students. Together, we’ve created Wealth 101, an educational resource that will feature regular infographics on how to make responsible financial decisions: To start, here are our first two infographics for the project. The first deals with the problem of financial literacy, while the other showcases the financial concepts that we’ll be addressing as we build out Wealth 101.

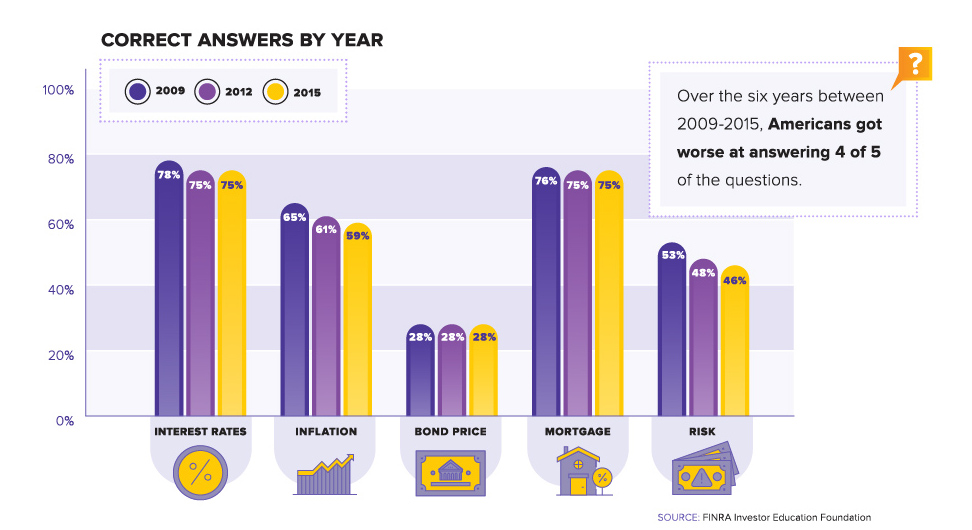

The Financial Literacy Problem

Financial literacy has been dropping for years. This giant infographic shows why that’s a problem, and what we can do to make future generations more prepared:

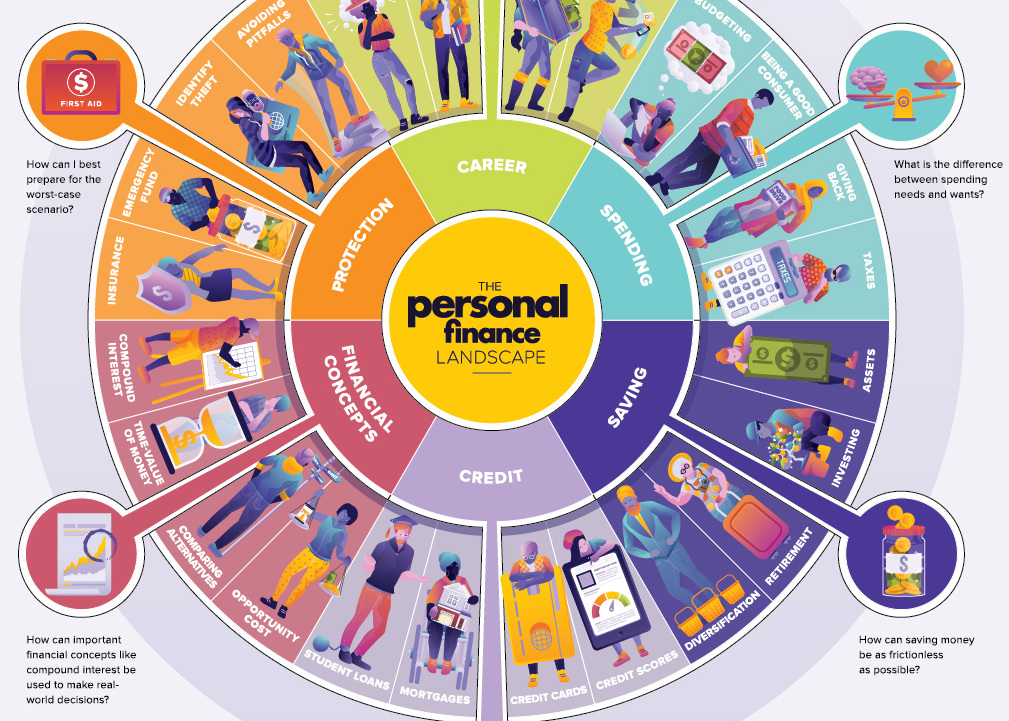

The Personal Finance Landscape

This personal finance wheel covers the most important concepts you need to know in order to gain financial independence:

Click on the above previews to see the full infographics. Lastly, we appreciate your support as we continue to build out this resource!

Founding Partners

NGPF is a free high-school personal finance curriculum and professional development partner helping teachers deliver essential money understanding in an easy-to-grasp, engaging way.

Visual Capitalist is a leading financial media site that creates and curates enriched visual content focused on emerging trends in business and investing. on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

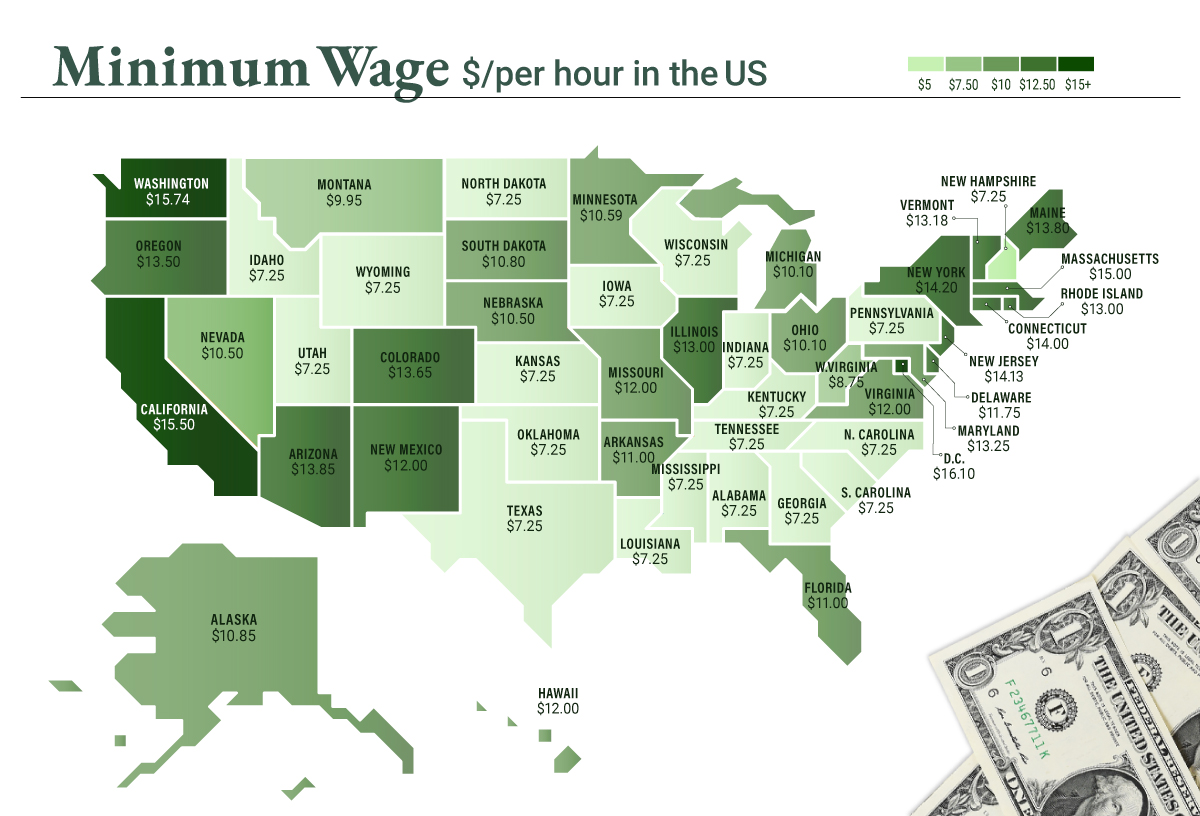

Minimum Wage in the U.S.

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.