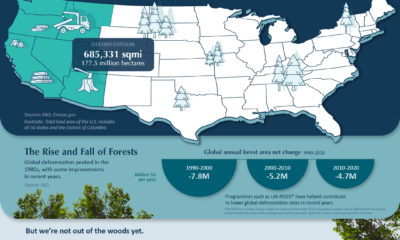

Forests are wellsprings of biodiversity and an essential buffer against climate change, absorbing billions of tonnes of carbon dioxide emissions every year. Yet, forest loss continues to grow. The above infographic sponsored by Carbon Streaming Corporation highlights the five primary drivers behind forest loss.

Deforestation vs. Degradation

‘Forest loss’ is a broad term that captures the impacts of both permanent deforestation and forest degradation. There is an important distinction between the two:

Permanent deforestation: Refers to the complete removal of trees or conversion of forests to another land use (like buildings), where forests cannot regrow. Forest degradation: Refers to a reduction in the density of trees in the area without a change in land use. Forests are expected to regrow.

Forest degradation accounts for over 70% or 15 million hectares of annual forest loss. The other 30% of lost forests are permanently deforested. Commodity-driven deforestation, which includes removal of forests for farming and mining, is the largest driver of forest loss. Agriculture alone accounts for three-fourths of all commodity-driven deforestation, where forests are often converted into land for cattle ranches and plantations. The harvesting of forestry products like timber, paper, pulp, and rubber accounts for the largest share of forest loss from degradation. This process is often managed and planned so that forests can regrow after the harvest. Shifting agriculture and wildfires each account for around 5 million hectares or one-fourth of annual forest loss. In both cases, forests can replenish if the land is left unused. Urbanization—the conversion of forests into land for cities and infrastructure—is by far the smallest contributor, accounting for less than 1% of annual forest loss.

How Much Carbon Do Forests Absorb?

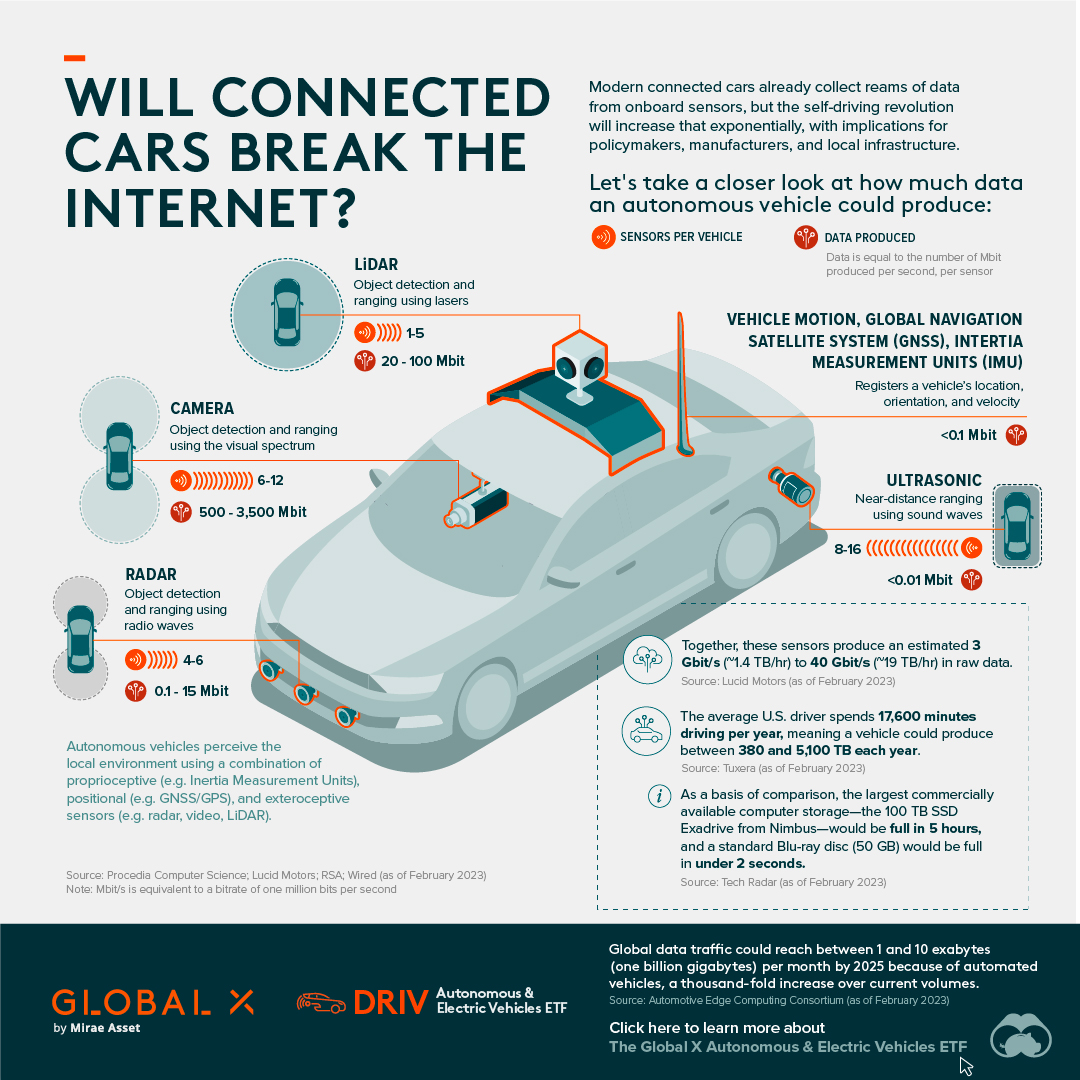

The world’s forests absorbed nearly twice as much carbon dioxide (CO2) as they emitted between 2001 and 2019, according to research published in Nature. On a net basis, forests sequester 7.6 billion tonnes of CO2 equivalent (CO2e) annually, which equates to around 15% of global CO2e emissions. As the impacts of climate change intensify, protecting forests from deforestation and degradation is increasingly critical. Carbon Streaming Corporation accelerates climate action through carbon credit streams on REDD+ projects that protect the Earth’s forests. Click here to learn more now. Source: Our World in Data on Today’s connected cars come stocked with as many as 200 onboard sensors, tracking everything from engine temperature to seatbelt status. And all those sensors create reams of data, which will increase exponentially as the autonomous driving revolution gathers pace. With carmakers planning on uploading 50-70% of that data, this has serious implications for policymakers, manufacturers, and local network infrastructure. In this visualization from our sponsor Global X ETFs, we ask the question: will connected cars break the internet?

Data is a Plural Noun

Just how much data could it possibly be? There are lots of estimates out there, from as much as 450 TB per day for robotaxis, to as little as 0.383 TB per hour for a minimally connected car. This visualization adds up the outputs from sensors found in a typical connected car of the future, with at least some self-driving capabilities. The focus is on the kinds of sensors that an automated vehicle might use, because these are the data hogs. Sensors like the one that turns on your check-oil-light probably doesn’t produce that much data. But a 4K camera at 30 frames a second, on the other hand, produces 5.4 TB per hour. All together, you could have somewhere between 1.4 TB and 19 TB per hour. Given that U.S. drivers spend 17,600 minutes driving per year, a vehicle could produce between 380 and 5,100 TB every year. To put that upper range into perspective, the largest commercially available computer storage—the 100 TB SSD Exadrive from Nimbus—would be full in 5 hours. A standard Blu-ray disc (50 GB) would be full in under 2 seconds.

Lag is a Drag

The problem is twofold. In the first place, the internet is better at downloading than uploading. And this makes sense when you think about it. How often are you uploading a video, versus downloading or streaming one? Average global mobile download speeds were 30.78 MB/s in July 2022, against 8.55 MB/s for uploads. Fixed broadband is much higher of course, but no one is suggesting that you connect really, really long network cables to moving vehicles.

Ultimately, there isn’t enough bandwidth to go around. Consider the types of data traffic that a connected car could produce:

Vehicle-to-vehicle (V2V) Vehicle-to-grid (V2G) Vehicles-to-people (V2P) Vehicles-to-infrastructure (V2I) Vehicles-to-everything (V2E)

The network just won’t be able to handle it.

Moreover, lag needs to be relatively non-existent for roads to be safe. If a traffic camera detects that another car has run a red light and is about to t-bone you, that message needs to get to you right now, not in a few seconds.

Full to the Gunwales

The second problem is storage. Just where is all this data supposed to go? In 2021, total global data storage capacity was 8 zettabytes (ZB) and is set to double to 16 ZB by 2025.

One study predicted that connected cars could be producing up to 10 exabytes per month, a thousand-fold increase over current data volumes.

At that rate, 8 ZB will be full in 2.2 years, which seems like a long time until you consider that we still need a place to put the rest of our data too.

At the Bleeding Edge

Fortunately, not all of that data needs to be uploaded. As already noted, automakers are only interested in uploading some of that. Also, privacy legislation in some jurisdictions may not allow highly personal data, like a car’s exact location, to be shared with manufacturers.

Uploading could also move to off-peak hours to even out demand on network infrastructure. Plug in your EV at the end of the day to charge, and upload data in the evening, when network traffic is down. This would be good for maintenance logs, but less useful for the kind of real-time data discussed above.

For that, Edge Computing could hold the answer. The Automotive Edge Computing Consortium has a plan for a next generation network based on distributed computing on localized networks. Storage and computing resources stay closer to the data source—the connected car—to improve response times and reduce bandwidth loads.

Invest in the Future of Road Transport

By 2030, 95% of new vehicles sold will be connected vehicles, up from 50% today, and companies are racing to meet the challenge, creating investing opportunities.

Learn more about the Global X Autonomous & Electric Vehicles ETF (DRIV). It provides exposure to companies involved in the development of autonomous vehicles, EVs, and EV components and materials.

And be sure to read about how experiential technologies like Edge Computing are driving change in road transport in Charting Disruption. This joint report by Global X ETFs and the Wall Street Journal is also available as a downloadable PDF.