Based on MSCI research of All Country World Index (ACWI) constituent companies, the graphic above reveals a 10-year trend of women’s representation on corporate boards, and projects three future scenarios on the way to parity.

ESG Goals: The Path to Parity

The ESG ecosystem considers 30% representation to be a critical milestone on the road to reaching gender parity on corporate boards of directors. Following a small uptick in 2019—and two years of slowed growth from 2017 to 2018—the rise of women on boards slowed again in 2020, gaining 0.6 percentage points (p.p.). Based on different forward-looking scenarios, here’s how long it could take to reach equal representation: Source: MSCI ESG Research LLC as of Oct. 30, 2020. On the whole, parity on corporate boards could be reached as early as 2039 or as late as 2070.

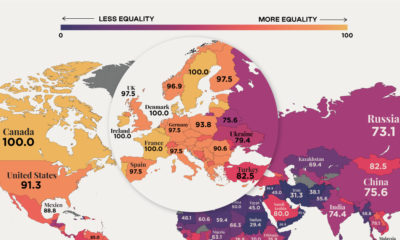

Women’s Representation: State of the Unions

MSCI research reveals trends that highlight significant traction. In 2020, fewer women became directors, but all-male boards continued to decline worldwide to 17% in 2020 (a 2 p.p. drop) among the ACWI contingent. This trend is partially driven by emerging markets, where all-male boards dropped to 31%, from over 34% initially. Hong Kong is one of the few countries that actually experienced an increase of 5 p.p. in all-male boards. In contrast, Saudi Arabia’s share reduced by 8 p.p. to 86% in 2020. Source: MSCI ESG Research LLC as of Oct. 30, 2020. Europe continues to lead the world in gender representation on boards. All top 10 countries with three or more women directors are found in the region, with countries like Norway, Italy, and Belgium being the closest to reaching parity. Across sectors, utilities experienced the largest increase in companies with three or more women on boards, with a 9% jump between 2019-2020.

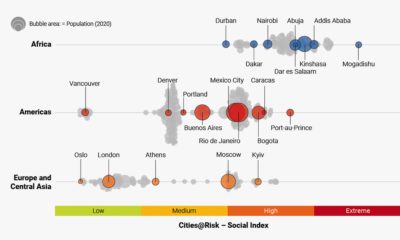

The Other Glass Ceiling: The C-Suite

The number of women CEOs remains low across all regions, but CFO roles show more promise. Source: MSCI ESG Research LLC as of Oct. 30, 2020. This global rise is also largely thanks to emerging markets. Since 2017, emerging market companies have exhibited higher percentages of CFOs than companies in developed markets, and the difference is widening.

The Glass Ceiling Isn’t Unbreakable

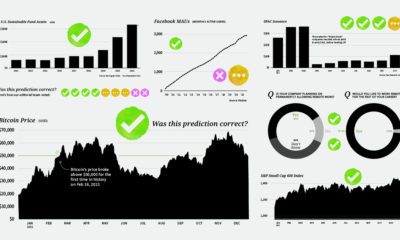

As MSCI reports, the progress towards parity in boardrooms does not necessarily represent the workplace. Emerging research suggests that women have been more negatively impacted by the pandemic’s economic fallout—potentially undoing several years’ worth of improvements. However, developing nations still show promising results in key indicators of gender diversity, with further opportunity to grow corporate bottom lines. As more post-pandemic recovery data becomes available amidst vaccine rollouts, we’ll gain a better sense of whether we’re still on track to follow these long-term trends. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.