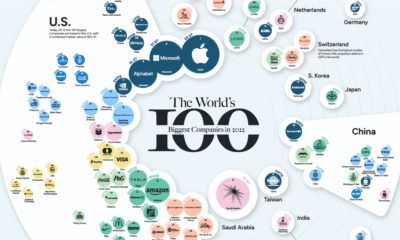

Over half of the most valuable global brands have experienced a decline in brand value, a measure that takes financial projections, brand roles in purchase decisions, and strengths against competitors into consideration. But where some have faltered, others have asserted their dominance and stepped up for their customers like never before. The visualization above showcases the top 50 most valuable global brands from a study conducted by Interbrand, which calculates brand value across hundreds of companies. As consumers move cautiously into 2021, which brands have they chosen to keep by their side?

The Heavy Hitters

In particular, Microsoft—who overtook Google in this year’s ranking—has increased its brand value by $100 billion in just one decade. The tech giant has reinvented itself over the years by focusing not just on how its products impact consumers’ lives, but instead on how they impact the planet. The company is promising to become carbon negative by 2030. However, other brands that sit at the top of the global brands list have not had the same recent success. Coca-Cola for example sits in sixth place, but has seen a decline in brand value of over $13 billion since 2010. Here is the full list of the most valuable global brands in 2020: It is clear that brands that went above and beyond during the COVID-19 pandemic not only benefit from more meaningful connections with their customers; it also pays financially—with brand value for all 100 companies included in the study totaling $2 trillion.

Movers and Shakers

Not too far behind these brands is PayPal, which saw 38% growth in the last year due to some major strategic pivots. More recently, the brand announced it would be redirecting capital from shareholders and investing in low-level employees who have been essential during the pandemic. Other brands making their mark in 2020 are Instagram, Tesla, and YouTube—all of which are new to the ranking and are experiencing significant growth in brand value. In fact, electric vehicle company Tesla experienced a 769% increase in market capitalization in just twelve months, making it the world’s most valuable automaker.

The Great Brand Shift

As pharmaceutical companies begin distributing vaccines across the globe, consumer optimism is starting to build again. However, the future of brands remains uncertain. Only 41 out of 100 most valuable global brands remain in the ranking today from the study conducted in 2000. With almost 60 hugely influential brands falling out of favor in the last two decades, there are several ways in which today’s brands can build economic resilience and thrive in an anxious world: Although the impacts of 2020 will be felt for years to come, brands that stay ahead of consumers’ changing expectations will be in a better position to weather the storm. on Similar to the the precedent set by the music industry, many news outlets have also been figuring out how to transition into a paid digital monetization model. Over the past decade or so, The New York Times (NY Times)—one of the world’s most iconic and widely read news organizations—has been transforming its revenue model to fit this trend. This chart from creator Trendline uses annual reports from the The New York Times Company to visualize how this seemingly simple transition helped the organization adapt to the digital era.

The New York Times’ Revenue Transition

The NY Times has always been one of the world’s most-widely circulated papers. Before the launch of its digital subscription model, it earned half its revenue from print and online advertisements. The rest of its income came in through circulation and other avenues including licensing, referrals, commercial printing, events, and so on. But after annual revenues dropped by more than $500 million from 2006 to 2010, something had to change. In 2011, the NY Times launched its new digital subscription model and put some of its online articles behind a paywall. It bet that consumers would be willing to pay for quality content. And while it faced a rocky start, with revenue through print circulation and advertising slowly dwindling and some consumers frustrated that once-available content was now paywalled, its income through digital subscriptions began to climb. After digital subscription revenues first launched in 2011, they totaled to $47 million of revenue in their first year. By 2022 they had climbed to $979 million and accounted for 42% of total revenue.

Why Are Readers Paying for News?

More than half of U.S. adults subscribe to the news in some format. That (perhaps surprisingly) includes around four out of 10 adults under the age of 35. One of the main reasons cited for this was the consistency of publications in covering a variety of news topics. And given the NY Times’ popularity, it’s no surprise that it recently ranked as the most popular news subscription.